Artificial intelligence (AI) has become a central driver of economic growth and strategic influence worldwide, and the Gulf states have been at the forefront of this transformative trend in recent years. Traditionally reliant on oil wealth, the Gulf states have recognized that AI offers a promising avenue to diversify their economies and assert influence in a rapidly evolving world. Recent research shows that AI will be a strategic determinant of national power capable of powerful transformations with a broader and faster impact.

From Saudi Arabia’s Vision 2030 to the UAE’s National AI Strategy 2031, recent trends reveal that the Gulf states are investing heavily in AI research, development and deployment, aiming to integrate these technologies across key sectors. These investments and plans are not only intended to transform the countries into regional AI hubs but also are an attempt to complement their wider efforts to enhance their influence and status in an increasingly competitive regional landscape.

The Growing Significance of AI

The strategic importance of AI for the Gulf states is multifaceted. Economically, AI helps enhance efficiency and productivity, enabling businesses to optimize operations, reduce costs and introduce innovative products and services. For the Gulf states, this particularly aligns with their socioeconomic reforms and economic diversification agendas by reducing dependency on oil revenues and building knowledge-based economies.

Beyond domestic modernization, AI also holds geopolitical significance for the Gulf. The pursuit of AI capabilities invariably allows these countries to project soft power, attract foreign investment and emerge as indispensable partners in global digital supply chains. It is clear that the Gulf states’ strategic collaborations with both Chinese and Western technology firms reflect the intent to aid their strategic autonomy.

AI has also become central to the Gulf states’ national security. Intensifying regional rivalries and rapidly changing threat environments have propelled the integration of AI-driven surveillance, intelligence analysis and cyber defense. Autonomous and semi-autonomous technologies such as drones, smart sensors and predictive threat-assessment platforms are now more embedded within military and security operations. The growing utility and scope of AI are recognized across governance and security in the Gulf, driving advancements in internal security, smart urban management, healthcare and public service delivery.

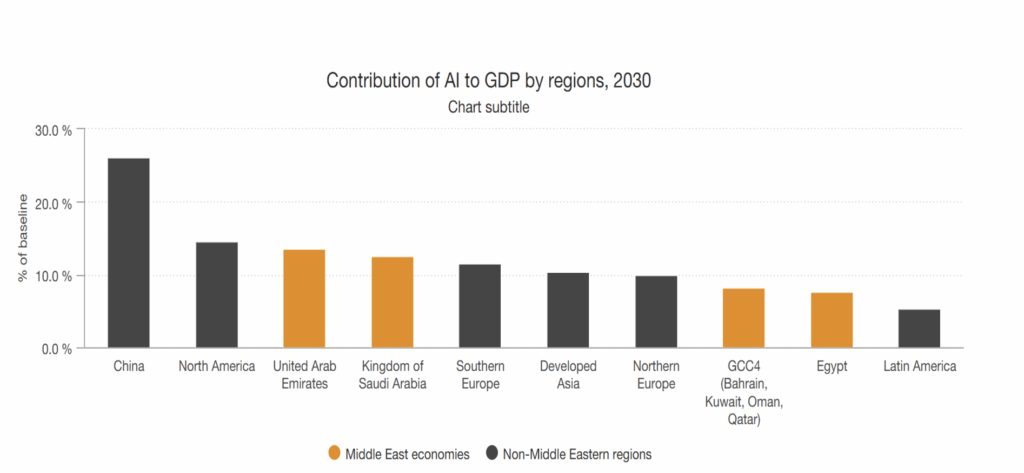

The significance of AI and its diverse applications makes it one of the most critical developments of our time. The value and impact of AI dominance increasingly parallels that of oil or rare earth elements in previous eras. Hence, export controls on advanced AI chips and semiconductors illustrate a shift toward technological protectionism, which is now evident in US restrictions targeting China and Beijing’s retaliatory policies. The Gulf states, having made substantial investments and attracted partnerships from both the United States and China, face the challenge of navigating intensifying geopolitical rivalries while advancing their own indigenous AI capabilities, especially as AI is set to immensely contribute to their GDPs as illustrated in the graph below.

Source: “The Potential Impact of AI in the Middle East?,” PwC, accessed November 18, 2025, https://bit.ly/3LDoJeb.

Recent AI Developments Across the Gulf States

As mentioned earlier, the Gulf states have made significant investments in AI, with the scale, scope and strategic orientation of these initiatives varying across individual countries. The UAE’s National AI Strategy 2031 aims to position the country as a global leader in AI by embedding AI technologies across all sectors and levels of governance by 2031. The UAE has pursued a diversified AI infrastructure strategy, as seen in projects such as the Stargate UAE consortium announced in May 2025. Led by G42 in collaboration with OpenAI, Oracle, NVIDIA, Cisco and SoftBank, Stargate aims to develop an AI data center campus in Abu Dhabi, initially deploying 200 megawatts with plans for further expansion. As per the plan, this is designed to serve as a regional hub. G42 has also signed strategic partnerships with Qualcomm and NVIDIA. The Abu Dhabi government, in collaboration with Microsoft and G42, is leveraging AI and the Public-Private-People Partnership model to drive digital transformation through a unified sovereign cloud capable of handling over 11 million daily digital interactions efficiently and securely. Google Cloud’s collaboration with the Dubai AI Campus and DIFC Innovation Hub in 2024 further reflects the UAE’s commitment to developing innovation clusters and scaling AI adoption across both public and private sectors.

Building domestic talent and attracting global expertise has also been integral to the UAE’s pursuit of advancing AI capabilities. The Mohamed bin Zayed University of Artificial Intelligence (MBZUAI), alongside the Technology Innovation Institute (TII), has anchored AI research, launching institutes focused on foundation models and Arabic-language AI models such as Noor and Falcon. These initiatives are intended to accentuate the UAE’s strategic shift from being a consumer of technology to an active producer of AI knowledge and innovation. With the region’s largest data center capacity and sovereign cloud frameworks, Abu Dhabi is not only securing digital sovereignty but is also emerging as a regional data hub with global reach, extending partnerships across Asia. Simultaneously, the integration of AI into defense and autonomous systems through entities like EDGE and collaborations with firms such as L3Harris reflects how the UAE aims to build an AI and machine learning center, helping to strengthen defense capabilities as well as enhance data-driven decision-making.

Qatar has also invested heavily in AI and has initiated landmark projects to advance its influence in the region’s technological landscape. Qatar’s AI strategy is pushed through comprehensive governance frameworks. The National AI Strategy and the GovAI initiative provide structured mechanisms for adoption across government services, healthcare, finance and urban infrastructure. Qatar’s alignment with the US and EU regulatory frameworks is largely intended to facilitate multinational investment. Programs like the Digital Skills Framework are intended to address Qatar’s talent gap, enabling the country to build a local workforce capable of sustaining long-term AI development and innovation. One of the key milestones in this effort was the announcement of a $2.47 billion AI and digital innovation incentive package at the Qatar Economic Forum in May 2024. The purpose of this package is to catalyze AI adoption across the public and private sectors, foster local startups through programs like Start in Qatar and build a robust Arabic-language data ecosystem through projects such as Al-Fanar.

Complementing these domestic efforts, Qatar has actively pursued international partnerships. Collaborations with Microsoft and Google Cloud have expanded to include local cloud regions, government migration to Azure and hybrid cloud platforms as well as the deployment of AI and analytics solutions across sectors such as telecommunications and aviation. Ooredoo, Qatar’s leading telecom operator, has emerged as a strategic domestic partner, leveraging investments in data-center capacity and NVIDIA GPU technologies to establish regional AI infrastructure. Qatar recently signed a five-year deal with US-based Scale AI to deploy AI tools and training to enhance government services through predictive analytics, automation and data-driven decision-making. These initiatives illustrate Qatar’s dual approach of focusing on building domestic technological capacity while relying on global expertise to ensure rapid deployment and operational scalability amid increasing attention toward regional technological prospects.

Following the UAE and Qatar, Oman’s approach reflects a more cautious, skill-centered model aligning closely with its Vision 2040 objectives of economic diversification and technological advancement. Central to this effort is the National AI and Advanced Digital Technologies Program, which seeks to increase the digital economy’s contribution to GDP from 2% in 2021 to 10% by 2040. The program includes the development of a National Open Data Platform, a National Center for AI Research and Development and the creation of AI language models such as Oman GPT, reflecting Oman’s focus on localized AI innovation. As a result of these initiatives, investments in AI projects have totaled approximately $156 million between 2021 and 2024, with an additional $39 million earmarked for 2025.

Oman has complemented domestic initiatives with robust international collaborations with the United States as well as European countries. Oman has also partnered with Egypt to establish a $265 million AI and Advanced Technologies Zone in Muscat aimed at attracting global startups and fostering innovation. Other partnerships include collaborations with Taiwan, focusing on AI research, semiconductors and academic exchanges. Oman is also pursuing a semiconductor ecosystem under Vision 2040, focusing initially on OSAT operations and chip design centers, while attracting international investment and building local human capital. The strategies adopted by Oman prioritize enabling design and assembly partnerships to gradually build indigenous capacity.

Other countries like Bahrain and Kuwait have also rapidly advanced their AI strategies, embedding technology into economic, governmental and industrial priorities. Bahrain has pursued a comprehensive national approach, combining regulatory, investment and skills initiatives. In 2024, it introduced a standalone law for AI establishing licensing, liability and governance frameworks, followed by the National AI Policy, which emphasizes ethical deployment, public awareness and integration across healthcare, education and public services. Academic-industry collaborations, including the Bahrain Polytechnic AI Academy with Microsoft and the Cloud Innovation Center with Amazon Web Services, are primarily intended to support workforce development. Bahrain has also deployed AI in urban planning, agriculture, finance and customer services and is advancing defense applications, including maritime surveillance with UK-based SRT Marine Systems.

Kuwait has similarly prioritized AI through regulatory, infrastructural and investment measures aligned with Kuwait Vision 2035. The 2025–2028 draft National AI Strategy emphasizes government digital services, healthcare, education, workforce development and ethical frameworks. Kuwait has partnered with Microsoft to launch the region’s first AI-powered cloud region and integrate Copilot technology across government services. Kuwait has also implemented AI experiments, such as the virtual news presenter Fedha.

These developments in recent years, even amid a turbulent regional security situation, reflect the Gulf’s strategic pivot toward AI-driven economic diversification, technological sovereignty and public sector modernization. These efforts combine to enable conducive regulatory frameworks, international partnerships and talent development to place the Gulf states as AI and digital innovation leaders.

Saudi Arabia’s Rise as a Regional Leader in AI

Saudi Arabia has emerged as one of the most important pillars of the region’s technological transformation and a frontrunner in integrating AI into national development strategies. As part of Saudi Vision 2030, the kingdom has strategically accentuated national reform agendas and has catalyzed economic diversification through digital transformation and strategic international partnerships. AI has been positioned at the core of this strategy, encompassing industrial innovation, human capital development and sustainability.

The establishment of the Saudi Data and Artificial Intelligence Authority (SDAIA) in 2019 marked a significant step in operationalizing and streamlining the country’s AI ambitions. Tasked with implementing the National Strategy for Data and AI (NSDAI), SDAIA serves as both a regulatory and operational hub, fostering AI adoption across government, industry and research sectors.

Domestically, Saudi Arabia has invested heavily in developing AI infrastructure, including specialized data centers, cloud services and high-performance computing facilities. Saudi investments underscore the focus on capability and infrastructure, including semiconductors, energy-efficient data centers and AI factories. For instance, partnerships with NVIDIA involve the deployment of hundreds of thousands of advanced GPUs across AI factories designed to power high-performance AI workloads. Parallel agreements with AMD, Rackspace Arabia and XDS Datacenters aim to enhance digital infrastructure and host AI workloads.

Talent development and investments in research are key focus areas of Saudi Arabia’s AI ambitions. Saudi Arabia has been focusing on enhancing AI research within the country and was ranked 15th worldwide in AI research output for 2025, reflecting the kingdom’s growing academic contributions. SDAIA has launched extensive programs to train over 600,000 Saudis in AI skills, including academic initiatives, bootcamps and professional certifications. The Saudi Academic Framework for AI Qualifications is intended to streamline higher education in AI. Apart from these plans, the SAMAI initiative aims to train 1 million Saudi citizens with AI competencies. Such efforts are driven by the focus to enhance indigenous capacity and capability, thereby reducing long-term dependency on foreign enterprises and personnel.

In the current global technological landscape, international partnerships are crucial for AI development, as countries with the most advanced AI capabilities and infrastructure lead global innovation, while other nations rely on collaboration to access expertise, technology and the resources necessary to build their own AI capacity. Saudi Arabia has actively collaborated with leading US firms such as Microsoft, IBM, AWS, Qualcomm, AMD and NVIDIA, establishing centers of excellence, AI zones and infrastructure projects. These partnerships not only enhance domestic capabilities but also align Saudi AI development with US technological standards. During President Donald Trump’s visit in May 2025, the kingdom announced a historic $600-billion investment package in the United States, encompassing energy, technology, defense and infrastructure. Key components included $20 billion from DataVolt toward AI infrastructure, alongside $80 billion in technology investments spanning Google, Oracle, Salesforce, AMD and Uber.

Sustainability and environmental considerations are also envisioned in Saudi Arabia’s AI deployment. Collaborations between IBM and the Ministry of Energy utilize AI for carbon emission detection, mapping and reduction, demonstrating the application of AI in addressing complex environmental challenges. Similarly, the NEOM-DataVolt partnership aims to develop a 1.5 GW net-zero AI project in the Oxagon industrial zone by 2028, combining energy efficiency with advanced technological innovation. Such initiatives highlight Saudi Arabia’s broader strategy to harness AI not only for economic leverage but also to meet environmental and sustainability goals that remain a top priority for the country.

In the defense sector, AI is being operationalized to enhance decision-making, predictive maintenance and real-time response capabilities. Saudi Arabia has signed deals with France to develop AI-driven defense capabilities. Moreover, amid escalating cyber threats, Saudi Arabia is investing heavily to build proactive, AI-integrated cybersecurity systems that safeguard its rapidly digitizing economy.

Saudi Arabia’s ongoing transformation is poised to have far-reaching implications for the broader regional order. As Saudi Arabia increasingly invests in technological transformation and AI, it is steadily positioning itself as a critical node driving regional digital and economic growth. These developments, when analyzed in conjunction with Saudi Arabia’s diplomatic, political and economic influence, will invariably redefine regional power dynamics, elevating Saudi Arabia’s geopolitical prominence.

Leveraging Sovereign Wealth Funds

Gaining a competitive edge in AI demands substantial investment, and any country aspiring to lead in this field must commit significant financial resources to research, infrastructure and innovation. The Gulf states have strategically utilized their sovereign wealth funds (SWFs) to spearhead investments in AI and big tech.

Saudi Arabia’s Public Investment Fund (PIF) has emerged as the central driver of AI ambitions through initiatives such as Humain, a state-backed enterprise developing large language models, data centers and AI infrastructure. With plans for a $10 billion global venture fund and ambitions to deploy 6.6 gigawatts of data-center capacity, PIF’s investments signify a calculated attempt to reposition Saudi Arabia as a regional AI hub. Similarly, reports of a $40 billion AI-focused fund and collaborations with NVIDIA and AMD underscore Saudi ambitions to achieve technological autonomy. Saudi Arabia’s investments are also intended to strengthen its industrial transformation and manufacturing capabilities. The PIF’s $100 billion investment vehicle, Alat, aims to establish the kingdom as a regional hub for AI-driven industrialization, green energy and advanced manufacturing. Other notable initiatives include a $150 million partnership with SoftBank Group to develop a fully automated robotics and engineering hub in Riyadh and a $200 million joint venture with China’s Dahua Technology to manufacture AIoT products and smart city solutions.

The UAE has emerged as another leading frontrunner in the Middle East, leveraging its SWF to accelerate its AI ambitions. One of the central pillars of these efforts is Group 42 (G42), an Abu Dhabi–based technology conglomerate partly owned by Mubadala, a state-owned global investment company. G42 has also launched MGX, an investment firm dedicated to advancing AI, data centers, connectivity and semiconductor technologies. MGX, launched with an asset target of $100 billion, seeks to invest across AI infrastructure, cloud computing and start-ups, while Abu Dhabi Investment Authority’s (ADIA) stakes in US data analytics and semiconductor ventures reflect the UAE’s pursuit of strategic partnerships to secure AI access and expertise. In April 2024, Microsoft invested $1.5 billion in G42 while establishing a regional AI skills fund and co-innovation initiatives on Azure. This deal is also seen to be a step toward deepening UAE-US technological collaboration and underscores Abu Dhabi’s ambition to integrate its AI ecosystem with global AI platforms.

Similarly, Qatar has channeled its sovereign wealth toward advancing its own technological and AI capabilities. Qatar’s SWF, Qatar Investment Authority (QIA), has played a pivotal role in empowering Qatar’s technological ambitions. Qatar has increasingly invested in US-based AI startups and digital infrastructure projects, and notable investments include a $3 billion digital infrastructure platform with Blue Owl Capital and stakes in quantum computing ventures such as Quantinuum. These developments, as mentioned earlier, are a part of Qatar’s broader economic diversification agenda, Qatar National Vision 2030. Through investments in infrastructure, talent development and global partnerships, Qatar aims to transform its economy by integrating AI across key sectors. QIA plays a pivotal role in driving these ambitions.

Oman has pursued notable technology collaborations with the United States in recent years, exemplified by the Oman Investment Authority’s (OIA) recent investments and engagement in broader discussions under the 2024 US–Omani Strategic Dialogue. Oman invested $155.9 million in AI in 2024, including a stake in Elon Musk’s xAI, as part of its strategy to diversify its economy and strengthen global tech collaborations. Oman Data Park upgraded its AI capabilities with the advanced and much sought-after NVIDIA H200 GPUs, while Oman has also launched its first AI Zone in Al Seeb to position itself as a regional technology hub. Investments by OIA underscore Oman’s commitment to integrating advanced technologies and strengthening infrastructure.

In recent years, Kuwait and Bahrain have also followed the regional trend of leveraging their SWFs to advance investments in AI and emerging technologies. The Kuwait Investment Authority (KIA) has joined large-scale AI infrastructure ventures, notably partnering with Microsoft and BlackRock in a $30 billion global AI infrastructure fund. Bahrain’s SWF, Mumtalakat, has partnered with US-based SandboxAQ to deploy advanced AI and quantum models for drug discovery and biotech innovation.

By leveraging their financial power to shape emerging digital infrastructures, the Gulf states are not only spearheading economic diversification but are also enhancing the region’s status in the evolving global AI order. These investments mark a significant move toward data and technological sovereignty, positioning the Gulf states as pivotal players in the emerging global technological landscape.

Limitations, Challenges and Risks

Like any critical sector, the growth and development of AI comes with inherent challenges and risks, particularly amid intensifying global competition given its far-reaching implications. The evolving landscape of AI in the Gulf reflects the vulnerabilities emanating from the intensifying rivalry between the United States and China. In recent years, the Gulf states have partnered with both the United States and China, especially in the technological sector. The Digital Silk Road has become a key instrument for expanding China’s technological influence in the Gulf amid intensifying US–China rivalry. So far, Chinese companies are adopting technology localization and hedging strategies to ensure compliance and long-term integration within Gulf digital governance systems.

Saudi enterprises have partnered with Chinese technology giants such as Huawei and Alibaba Cloud. The agreements between Riyadh and Beijing focus on training Saudi specialists, integrating Arabic language capabilities into AI platforms and developing smart city and healthcare solutions. Notably, Huawei’s establishment of a $400 million cloud region in Riyadh and collaborations with DeepSeek and Zhipu AI reflect the kind of engagement between both countries, even as Riyadh’s main technological partner remains the United States in terms of scope and scale. However, growing regulatory pressures and intensifying US–China rivalry are creating challenges globally, with Gulf powers, who have thus far maintained a careful balance in their engagements, also experiencing these conundrums.

Although the UAE has managed to enhance ties with the United States and has continued partnering with Chinese firms, the UAE has also recalibrated its AI strategy to align more closely with the United States amid concerns over data security and technological dependence. As per some reports, Abu Dhabi’s G42 has divested all investments in China, including a $100 million stake in ByteDance, reflecting its pivot away from Chinese firms toward collaboration with US tech giants. Abu Dhabi-based Lunate reportedly took over the management of G42’s $10 billion China-focused 42X Fund after G42’s divestment from China amid US pressure and concerns over its ties to Chinese technology giants. This repositioning may also have been instrumental in securing US approval for NVIDIA’s H100 chip exports to the UAE, along with other key deals, reinforcing its inclusion within the Western technology ecosystem.

Meanwhile, the Gulf states continue to engage with China in certain areas where cooperation has already been well established. Huawei and Alibaba Cloud have expanded their data center networks in Saudi Arabia, the UAE and Kuwait, with Huawei’s Riyadh data center and Alibaba Cloud’s second Dubai facility serving as pillars of China’s sovereign cloud expansion. These developments illustrate Beijing’s role in contributing to the Gulf’s digital architecture. Qatar has also engaged with Chinese tech firms. Qatar’s Science and Technology Park (QSTP) has signed a deal with Kingdee International and Huawei on projects in smart manufacturing and AI-driven logistics.

These developments unfold against the backdrop of tightened US export controls on advanced semiconductors to China, which have reshaped global AI supply chains, compelling the Gulf states to reorient their technology strategies. The Gulf’s integration with US firms such as NVIDIA, Microsoft and OpenAI enhances access to cutting-edge technologies and embeds regional AI ecosystems within US-centric regulatory and security frameworks. President Trump’s recent announcement of multibillion-dollar AI deals with the Gulf states, including major partnerships with NVIDIA, AMD, Qualcomm and Amazon, further underscores this realignment. While such initiatives aim to bolster US global AI leadership, they have triggered domestic concerns in Washington over potential technology leakage to China via Gulf intermediaries, amplifying geopolitical tensions surrounding AI diffusion. This could eventually create strains not only for the Gulf states but also for all states seeking to engage with both the United States and China, as it will reduce their overall flexibility.

Apart from geopolitical risks and challenges, the Gulf states also face structural limitations, particularly a shortage of a skilled local workforce and limited high-tech manufacturing capabilities. For example, the production of semiconductors, a critical component underpinning AI and advanced technologies, remains heavily concentrated in a few countries with established industrial bases and technical expertise such as China, the United States and South Korea. This concentration highlights the Gulf’s dependency on external suppliers and underscores the long-term challenge of developing indigenous technological self-sufficiency. As geopolitical tensions between the United States and China escalate, the semiconductor sector has become a primary battleground shaping the contours of their strategic rivalry. For the Gulf states, this global dependency underscores both the strategic vulnerabilities of their digital ambitions and the urgency to secure resilient supply chains through diversified partnerships. Given the complexity and capital-intensive nature of this sector, developing an indigenous semiconductor industry is likely to remain a long-term aspiration rather than an immediate possibility.

That said, Gulf governments are aware that sustained technological competitiveness depends on early ecosystem development, particularly in design and research capacity. This recognition has prompted these countries to launch foundational initiatives aimed at nurturing domestic talent and partnerships. Through initiatives such as the Saudi Semiconductors Program (2022) and the National Semiconductor Hub (2024), Riyadh is pursuing an “ecosystem-first” approach focusing on design, research and talent development before large-scale fabrication. Backed by substantial investments, including a $500 million venture capital fund and Alat’s $2 billion partnership with Lenovo, Saudi Arabia aims to position itself as a high-tech manufacturing hub and a strategic bridge connecting Asia, Europe and Africa. Saudi Arabia has been investing heavily in local semiconductor manufacturing to reduce dependence on a concentrated global supply chain and strengthen its position in the industry. The UAE and Oman have also initiated ambitious plans to transform into semiconductor manufacturing hubs. So far, the scale of investments and the strategic direction of current initiatives indicate meaningful progress and a strong commitment toward long-term capability building.

Conclusion

The Gulf states’ AI initiatives have strategically positioned the region at the forefront of global AI transformation by integrating technology into national development agendas, leveraging sovereign wealth funds, improving business environments and enhancing global partnerships. For the Gulf states, investments in AI are far more than a diversification agenda; they are central to the region’s long-term economic transformation and modernization. Hence, these countries are aware of the stakes involved and are undertaking comprehensive measures to ensure that their AI strategies succeed by balancing innovation, economic resilience and geopolitical alignment.

Despite expanding partnerships, the Gulf states will have to carefully consider Washington’s growing concerns over China’s deepening involvement in their technological sectors. These apprehensions, recently voiced by some US senators and representatives, reflect the broader strategic anxiety surrounding Beijing’s role in critical infrastructure and digital ecosystems. Given the Gulf’s longstanding security alliance with the United States, any actions that could strain this partnership carry significant strategic implications. The Gulf states are therefore seeking to maintain a delicate balance by continuing to engage with China through the Digital Silk Road framework while remaining sensitive to US security priorities. It was evident from Trump’s Gulf tour that the United States now wants to counter China’s growing presence in the regional technological landscape. As long as US-China competition is managed well, this calibrated approach allows Gulf governments to pursue technological diversification without jeopardizing their security alliances.

Ultimately, the future will depend on how effectively regional actors can actually reconcile technological interdependence with geopolitical caution. Given their strategic significance, the Gulf states have become an arena of great-power competition, where technological development and security are increasingly intertwined. As both opportunities and challenges expand in tandem, the success of their strategies hinges on the region’s ability to assert agency in a competitive environment.