Executive Summary

This research aims to trace the course of the political economy of the Islamic Republic of Iran over the past 40 years, and to measure the results of this path on the long-awaited revival of the Iranian people which is related to economic recovery based on real indicators and real facts. We noticed a set of obstacles and structural imbalances that prevented the development and revival of the Iranian economy as appropriate for its natural and human capabilities. Those obstacles also prevented what every Iranian desired since the revolution four decades ago. We identified them in seven structural imbalances: three of them in the paper copy of the Iranian issues series. Most of them were not necessarily related to the external sanctions which the regime was subjected to over its lifetime.

Some of the imbalances of the desired economic revival were intellectual and ideological. They related to suspicion and caution in dealing with the other or non-Iranians, and ambitions of expansion outside Iran’s borders. Some of the ideological imbalances are linked to the promotion of beliefs over economic interests. Some of them are administrative like corruption and bureaucracy. Many of these imbalances are related to economic obstacles whether they took root since the establishment of the republic and are linked to the economic thought of the Supreme Leader Ruhollah Khomeini and the ruling elites that politicize economic interests, or whether they have arisen in response to the nature of the policies pursued. As result, this has left chronic problems such as inflation, challenges of economic growth, poverty, distribution of wealth, and management of the state’s resources and capabilities. These imbalances have deepened with time and their effects continue to this day. Therefore, they were and will be a stumbling block to the revival that Iranians seek, even if there are no sanctions in the future, until these obstacles are confronted and rooted out.

Introduction

Many wonder – including many Iranians – about the reasons why the Iranian economy’s revival has been delayed over the past four decades following the Iranian revolution, which gave precedence to economic prospects and aspirations. Many also wonder about the reasons behind the low incomes and living standards of most Iranians and Iran’s lagging economy compared to similar oil-producing countries. This comes despite the discovery of oil in Iran before many countries in the Middle East, the Iranian state’s access to diverse natural and human resources, an industrial and technological legacy inherited from the capitalist Shah government and its distinguished geographic location and cultivable soil.

Of course, there were some positive developments in the livelihoods of Iranians after the revolution. These developments appeared in the the social sphere after the state shifted its focus from the elites and urban areas to the destitute and rural classes and expanded access to basic services such as electricity, water and education in the countryside early in the era of the new republic. The boom in oil prices at that time helped the government do so.[1]

But as time passed, the level of these services deteriorated, which encouraged domestic migration from rural to urban areas.[2]

Despite possessing natural and human resources, there has not been any progress based on a clear strategy to regulate and build the economy according to a clear economic model. Iranians born after the revolution, including young men today, found better opportunities for education but without sufficient job opportunities after graduation. One out of three bearers of university degrees are unemployed. If they find jobs, the income is always low and does not help to meet the basic necessities of life amid declining purchasing power and the ongoing surge in prices, which in many cases surpasses 40 percent. As for the conditions of the poor, after their circumstances improved and the rates of poverty across society declined during the third decade of the revolution, their situation soon declined with poverty surpassing the rates it reached in the 1970s-before the revolution – with poverty becoming a threat to more than 50 percent of Iranian families despite all the potential the Iranian state possesses.

The Iranian economy is still depends on primary sectors such as oil, gas and agriculture, while the industrial sector is suffering from aging. It is in need of significant investment to upgrade it. This comes as Iran’s economic development has faced sharp volatility. The annual average growth of Iran’s economy over the past four decades has not surpassed 1.8 percent, which is much lower than that of regional countries that have population figures close to those of Iran such as Egypt and Turkey, which do not have rich resources like Iran.

As for Iran’s per capita gross domestic product at constant prices, it was below 7,000 dollars per year until 2017,[3] which is less than half the global average. Moreover, it is less than the Iranian GDP per capita in 1978, one year before the revolution. If we take into consideration the sharp inflation and exchange rate volatilities over the last two years, Iranian GDP per capita would be much lower.

Some Iranians attribute the delay of the economic revival to the huge population growth that the country witnessed after the cleric-led uprising in 1979. This growth resulted in the doubling of Iran’s population in four decades, from 37 million in 1979 to nearly 84 million in 2020.[4]

Others believe that the reason is Western hostility towards the ideas and principles of the 1979 revolution in Iran, especially from the US, which has imposed international sanctions on Iran since the revolution broke out.

The foregoing may contain some truth, especially in relation to the impact of sanctions on the Iranian economy. But historical experiences indicate that a significant population growth, or even the imposition of sanctions, can be a strong stimulus for economic revival most of the time if there is a strong will and an appropriate climate. China, Japan, South Korea, and Germany after World War II turned impediments and challenges into promising opportunities.

No one can negate the impact of the consecutive economic sanctions’ regimes which have targeted the government of the 1979 revolution. They have impeded economic growth and sustainable development.

But the facts show that they are not the sole reason behind the economy and livelihoods deteriorating.. Therefore, when we speak of the failure of the Iranian model in advancing the needs of man , which are linked to economic development, we base our conclusions on clear indicators and facts, not merely conjecture.

Therefore, this current research is a serious attempt which could lead to more research to delve further into the causes of this economic failure, both old and new.

The importance of this research lies in its novelty and the Arabic library’s need for it. This comes after reviewing former works, the first of which was published in 1990.[5]* The research will cover a period of four decades, from the outbreak of the Iranian revolution until mid-2020. The basic hypothesis of the research will be: there are a host of structural flaws which have impeded the advancement of the Iranian economy and society over the past four decades of the revolution’s rule. They are not totally linked to outside factors such as the sanctions. If these flaws continue to be unaddressed, they will continue to hinder economic development even if the sanctions are lifted in the future. The research will adopt an empirical analytical approach, citing historical incidents and statistical data in addition to applying economic analysis methods to prove the hypothesis.

The research is divided into four main theses. The first deals with deepening hostility towards the West and the state’s control over the economy. The second focuses on the volatility of economic policies and plans. The third revolves around chronic inflation and volatile economic performance. The fourth deals with imbalances within Iran’s general budget structures and a conclusion is presented. Three other theses will be completed in the printed edition of the ‘Iranian Issues Series’ as follows. The fifth thesis: politicizing and making ideology-oriented Iran’s economic interests. The sixth thesis: the failure to reduce the gap between incomes. Finally, the seventh thesis: the spread of major and minor corruption.

Theoretical Background

Perhaps it is necessary in the beginning to clarify some theoretical concepts in brief, such as the structural flaws and the desired economic renaissance. According to the Arabic Almaany Dictionary the word haikala (structure) means an administrative system or a host of rules restricting some matters or things. The verb ‘structure’ means growth .[6]

Here, this word mean those deep-rooted and well-established flaws/imbalances within the political, economic and administrative system of Iran since the revolution broke out. They have stood as impediments to achieving revival in its comprehensive sense, developing both the economy and society. The definition of revival means[7] a process of reviving economy and society or other aspects of advancement, modernization, and progress.

The structure deals with long-term aspects in relation to the evolution of a certain phenomenon. The term ‘imbalance’ refers to the unstable relationship between economic variables, according to the proportions and levels defined by economic theories. Structural imbalance means the imbalance among the components that make up the economic structure to an extent that impedes growth and stability.[8]

Some of these structural imbalances may be intellectual or ideological, such as hostile thoughts towards the other, derogatory views towards non-Persian minorities[9] and leaders of the Iranian political system adopting conspiracy theories when dealing with the outside world. Some imbalances involve administrative abnormalities such as corruption and excessive bureaucracy and some are economic such as bad policies in regard to managing resources and expenses, distributing wealth and the economic direction of the state and ruling elites.

I- Deepening Hostility Towards the West and Increasing the Economic Domination of the State

The Iranian government’s hostility towards the West and all its tenets has been clear since the first day of the 1979 revolution. This policy has continued to be pursued by all governments. This has caused Iran to be isolated for years while the debate about the pros and cons of globalization and cooperating with the West and opening the door to international trade and foreign investment has raged on. This came at a time when similar economic models in countries such as China and Brazil have reaped the benefits of cooperating with the West, moving much further than Iran in terms of economic development.

There were a host of reasons which boosted the economic direction, caused international isolation and tightened the state’s control over the economy. At the top of this list of reasons are the ideas and alignments of the supreme leader and the clerics, as well as the populist elites’ controlling the first constitution to be drafted in the country. This is in addition to constitutional provisions which expelled foreigners and strengthened the control of revolutionary institutions over the economy, resisted “reformists’” attempts after the Iraq-Iran war and placed obstacles which crowded out both local and foreign investment as we will detail.

- The Economic Orientations of Khomeini and Some Clerics

The Supreme Leader of Iran, Ali Khamenei, made an important statement, which became the basis on which the government establishes its anti-West policies.[10]

He said, “We should be cautious and break down what our enemies are doing. Let us see what they are interested in the most, and through this, we should understand that what they insist on will never be in the interests of Muslims and humanity. We are in need to know what they want through their words and actions. What we should do is we should look at the approach which they pursue and opt for the exact opposite one.”

The leader of the Iranian revolution and the first supreme leader of the new Islamic Republic Khomeini (1902-1989), in his revolutionary speeches before and after the revolution, enhanced the notion of adopting economic independence. This happens via economic growth depending on the country’s own domestic resources only, without any cooperation with foreigners. This is added to the necessity to resist the West, including its values, concepts and ideas which include economic secularism, which pose a threat to the independence of Iran, not only at the economic level but also at all levels, especially the political and cultural levels.

Additionally, the ideas of some Shiite clerics played an important role in shaping the economic vision of the supreme leader. The book titled ‘Our Economy’ authored by Iraqi Shiite cleric Mohammed Baqir al-Sadr had a significant impact on the economic thought of Khomeini before the revolution broke out.[11]

Sadr called for an economic system to be controlled only by the state, and viewed, the West, globalization and capitalism as factors threatening Islamic culture. The Paris-based economist and the first Iranian president of the republic after the revolution, Abolhassan Banisadr, was among the prominent supporters of the economic thoughts of cleric Baqir al-Sadr. This appeared when he authored a book titled ‘The Islamic Economy,’ which influenced revolutionary economic thought consistent with leftist economic principles that were prevalent before the revolution and supportive of an Islamic economy hostile to the ideas and orientations of the West. These orientations appeared in pre-revolutionary slogans such as ‘No Communism, No Imperialism … Only Islamic Leadership.’ Therefore, the ideas of Abolhassan Banisadr found a great deal of admiration among Iranian clerics, among them Khomeini himself. He approved the ideas and opened the door for their implementation after he returned from his exile in France after the fall of the Shah.

2- Domination of the Populist Elites Over the Constituent Assembly Formed Writing the Draft the First Constitution

The second factor that influenced the shaping of a hostile attitude toward the West contributing to Iran’s further isolation was when the populist elites and radicals’ dominated the constituent assembly formed by Khomeini in 1979 to draft the constitution. It was tasked with reviewing the draft of the first post-revolution constitution in Iran. On the other hand, the “moderate” elite had an insignificant representation in the constituent, and the Western-educated elite was denied the opportunity to draft the constitution, including those belonging to the European and American economic schools of thought. A quote attributed to Khomeini states: “Those tending to embrace the European schools of thought, whether Eastern or Western, and those who are affected by their deviant opinions, will not partake in drafting the constitution.”[12]

The populist elites preferred to curb foreign capital entering the country in order to achieve economic independence. They even imposed curbs on private property and created public revolutionary institutions. These elites – like Khomeini- had some negative historical experiences with foreign powers, such as the exploitation of Iran’s oil resources or the monopolization of the country’s wealth by some British, Russian or American firms. This was before the Iranian Shah Mohammad Reza Pahlavi ended global companies extracting, selling and marketing Iranian oil in 1973 after Mohammad Mosaddegh’s nationalization policies failed to meet the intended goals .[13]

3-Including Provisions in the Constitution Which Crowded out Foreigners and Lay the Foundations for Revolutionary Institutions to Control the Economy

Iran’s new elite, carrying this revolutionary thought, managed to establish an economic system where the state plays the main role, banning any Western economic activity. They also laid the foundations for revolutionary semi-governmental businesses such as cooperatives, also known as Bonyads. They work under the supervision of the religious establishment, and others work under the authority of the IRGC. They are cited as the best mechanisms to achieve social justice and meet the needs of the vulnerable and poor as they reinject part of their profits into society unlike the exploitive private sector and foreigners who control the resources of the country.

This resulted in some special constitutional provisions, such as those that ban the employment of foreign experts in the country, unless there is an urgent necessity with the approval of the Islamic Consultative Assembly, as set out in Article 82. There is also Article 42, which urges using all means possible to prevent foreigners from controlling the economy and to break away from being subordinate to foreigners, according to the article included in the 1982 constitution before it was modified thereafter in the amendments to the 1989 constitution. There is article 153 which stipulates that any form of agreement resulting in foreign control over the natural resources, economy, army, or culture of the country, as well as other aspects of national life, is forbidden.[14]

Thus, such provisions sowed the seeds of skepticism towards the West since the early years of the revolution. Most of these provisions are still applicable in the current constitution.

Article 44 of the constitution expanded the role of the state in the economy to include all the major sectors in Iran with the help of cooperatives, with the private sector complimenting their role. Article 44 provides for the following:

“The economy of the Islamic Republic of Iran is to consist of three sectors: state, cooperative, and private, and is to be based on systematic and sound planning.

The state sector is to include all large-scale and mother industries, foreign trade, major minerals, banking, insurance, power generation, dams and large-scale irrigation networks, radio and television, post, telegraph and telephone services, aviation, shipping, roads, railroads and the like; all these will be publicly owned and administered by the State.

The cooperative sector is to include cooperative companies and enterprises concerned with production and distribution, in urban and rural areas, in accordance with Islamic criteria. The private sector consists of those activities concerned with agriculture, animal husbandry, industry, trade, and services that supplement the economic activities of the state and cooperative sectors .”[15]

Therefore, Khomeini and his followers took control over how the constitution was drafted, thus laying the foundations for the state’s control over economic activity, banning any Western presence in the country, and weakening the confidence of the private sector with the exception of a selective group of ‘bazaar’ businessmen. Achieving economic independence has become the most remarkable slogans, and the most important revolutionary objective, for the government.

4-Standing up to “Reformist” Attempts After the War With Iraq

The isolation of the Iranian economy from the outside world, especially the Arab world, lasted eight years after the revolution. It only came to an end due to the urgent necessity to reconstruct what was damaged during the war with Iraq. Khomeini permitted some limited flexibility towards the West before his death in 1989. This was evident in the five-year plan between 1990-95 and free zones being granted permission to open during the era of Hashemi Rafsanjani (1989-1997) to build what was damaged by the war, whether infrastructure or production facilities, and ensuring the supply of consumer goods and products needed by society.

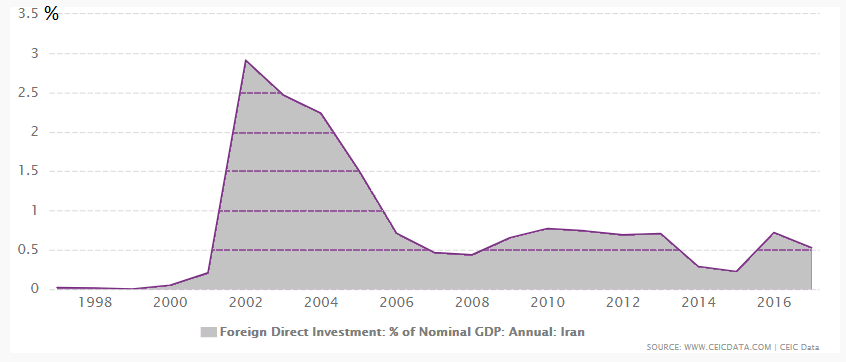

But, years after this limited flexibility, the flow of foreign investment in Iran faced opposition from the radical elites and the newcomers who wielded economic influence such as the IRGC and traders benefiting from the isolation. They feared that foreign capital would crowd them out. This was in addition to their desire to resist globalization and maintain economic independence according to the Iranian revolution’s vision. When the second supreme leader of the revolution Ali Khamenei (1989 through the present) expressed support for this opposition, President Hashemi Rafsanjani had no option but to reluctantly respond during his second presidential term. This appeared clearly in the 1996-2000 second five-year plan. Dependence on foreign investments was reduced as of 1996. (See Figure No. 1).

Figure No. 1: The Percentage of Foreign Direct Investment in Iran in Accordance to GDP (1997-2017)

Post-revolution Iran took nearly 20 years to merely realize the role of foreign investment in boosting economic growth. Here we do not speak of Iran’s doors opening absolutely, but of a cautious permission to some people with preconditions. This came after the research center of the Iranian parliament in 1999 recommended allowing foreign investment to enter the country, given the country’s need for technology and the lack of foreign investment in this respect in the first and second five-year plans. This happened during the era of Mohammad Khatami (1997-2005).

However, the Guardian Council refused to pass a bill to attract and protect foreign investments on three occasions in 2001 and 2002. It argued that the bill did not include any safety nets if foreign investors turned out to be spies and agents for the West and Israel in particular. This debate dragged on until Hashemi Rafsanjani passed the decision in late 2002 after he became the head of the Expediency Discernment Council. [16]

As was the case with the reformist attempts via President Rafsanjani, economic reform attempts continued under President Mohammad Khatami as well as to attempts to cooperate with the West. These attempts reached led to some powerful elites such as the IRGC and supreme institutions such as the Expediency Discernment Council intervening to terminate investment contracts which the government signed with foreign partners, some of which were concluded or about to be concluded. This happened with the Turkish company TAV after the opening of Khomeini Airport in Tehran in 2005 after the company was responsible for the airport’s logistics on the ground.[17]

In modern times, the Expediency Discernment Council has impeded the attempts of President Rouhani since he took office particularly his attempts to change banking transparency rules in accordance with what has been outlined by the Financial Action Task Force (FATF). This led FATF to place Iran on its blacklist on February 21, 2020, which has impacted banking operations and the expansion of Iranian trade overseas.

5- The Impediments Crowding out Local and Foreign Investments Over Time

As a natural outcome of the extreme caution and skepticism towards all that comes from the West since the revolution, impediments which caused the Iranian economy over the past four decades to crowd out foreign investment surfaced. Iran has realized its importance and sought to attract it at times. These impediments included setting conditions such as Iranians entering partnerships s with foreign investors desiring to work in Iran. Moreover, there was the IRGC-affiliated companies’ quiet control over some stakes in Iranian companies. This instilled hesitancy in the hearts of many foreign investors as they did not want to be involved in suspicious transactions and face international sanctions. This led to the percentage of foreign direct investment in the gross domestic product fluctuating from one year to another (See Figure No. 1). Foreign investment was confined to areas such as the oil industry, petrochemicals, and the auto industry. The level of investment was meagre ranging from zero at the end of the 1990s to $4 billion, the highest on record, in 2011.[18]

Bureaucratic impediments also surfaced, such as the multiplicity of laws and conditions intended to dissuade foreign investors from working in Iran. They included, but were not limited to, the banning of foreign investors from owning properties in Iran, resorting to only local courts and not international courts in the event of trade disputes, and the setting of some theoretical conditions to allow investors into Iran but without clarifying the mechanisms to implement them such as conditions relating to investors not posing a threat to national security and general interests or causing chaos in the country.[19]

This instilled concerns in most foreign investors about working in Iran’s business environment, and they gave up development opportunities, and opportunities to transfer technology and employ Iranian workers.

II- The Volatility of Economic Orientations and Plans

Iran had developed a five-year plan in 1990. This was the first five-year plan to be approved in the history of the republic. Since then, six five-year plans have been developed so far, whose guidelines are outlined by the supreme leader, seconded by the president of the republic’s office, and approved by the Iranian Parliament. It was noticed that there was volatility in the general economic policies and plans in the country. There was no steady trajectory or approach. The people and economy paid a huge price for this volatility, as we detail below:

- The Divergence of Economic Orientations of the Supreme Leader’s Office Between Openness and Isolation

Before the first five-year plan in 1990, there were development plans outlined by the Planning and Budget Organization in 1981 under the liberal interim government chaired by Mehdi Bazargan. But they were turned down as they were developed by technocrats who were described as ‘people with Western economic education’ who believed that achieving economic independence and self-sufficiency for revolutionary Iran should not lead to a closed economy isolated from the world. They were expelled from the Organization and were branded as ‘non-revolutionary’ elements. The war with Iraq hindered the plan for eight years until the end of the war in 1989.

However, economic policy saw little change during and after the war with Iraq towards allowing transactions with the outside world to import necessities. The share of imports in Iran’s GDP accounted for 50 percent and 24 percent in 1983 and 1988, respectively.

The volatile economic policies continued to shift between attempts to open the country and maintain isolation and between reform and resisting reform since the era of Supreme Leader Khomeini and Banisadr until the era of the current Supreme Leader Ali Khamenei and Hassan Rouhani. A president would come with reformist policies and his successor would bring populist policies, such as Ahmadinejad. Moreover, economic policy could change from one presidential term to another (as was the case with Rafsanjani, see subheading no. I).

The volatility of economic orientations included the two supreme leaders of the revolution. The first supreme leader, Ayatollah Khomeini, solidified the role of the state in running and taking control of the economy, according to Article 144 of the constitution as we previously mentioned. He opposed expanding the role of the local private sector and the presence of foreign capital in Iran. But before his death, under the weight of the economic pressures resulting from the eight-year war, he gave the green light for ‘cautious’ transactions and foreign investments with the outside world, however, he imposed complicated conditions (see subheading I).

Then the current supreme leader, Ali Khamenei, took power in June 1989 and permitted the reformist economic orientations of Rafsanjani during the first four years of his presidency. But he supported the radicals who opposed Rafsanjani’s orientations thereafter. Then he eased the restrictions in conjunction with the attempts of President Khatami to open and improve Iran’s image worldwide. He allowed Khatami to engage in dialogue with the world and to allow greater presence of foreign investment. He also accepted to minimize the role of the state in the economy in favor of the private sector- though nominally- when he allowed re-interpreting Article 44 of the constitution, which was concluded during the era of Khomeini, in June 2005.

The amended article made it permissible to privatize some public sector firms, restricting the expansion of the public sector in the future, with the latter abandoning any economic activities beyond those set out in Article 144 (the article was detailed in the first section) in favor of the private sector or cooperatives by at least 20 percent per year.[20]

This amendment helped many IRGC-affiliated companies to acquire major public sector companies such as the Telecommunication Company of Iran.

Khamenei himself soon retracted and questioned the benefits of economic cooperation with the Western world, especially the US and some European countries such as the UK and France. This happened when European and American sanctions were imposed on Iran between 2012 and 2018.

In consecutive speeches on occasions such as the Iranian new year, he called for the need to adapt to isolation and adopt the policies of a resistance economy. This marked a shift in the policies of the supreme leader towards supporting isolation and self-sufficiency, which are in the interests of the major entities in the country backed by the government, not the weak private sector.

Before his death, Khomeini left an important recommendation when it came to his vision about running the Iranian economy published in 1989. He said, “Islam does not support injustice and unrestricted capitalism which devours the assets of the people , nor does it support the Leninist-Marxist system which opposes private ownership. But Islam recognizes private ownership and respects it on a limited scale of production and consumption.”[21] This important statement indicates two important conclusions:

- It discloses the basic characteristics of the Iranian economy according to the founding father. It permits a strong role for the state via its institutions and firms in running the economy and they exhibited caution in regard to the private sector and its growth, and underscore the possibility to intervene to restrict its growth, whether in acquisition, production or consumption.

- The lack of a clear vision in determining the economic identity of the model or system the state adopts as well as the methods in implementing its universally acknowledged principles. The government did not implement the principles of a capitalist system such as restricting the role of the state or expanding private ownership, nor did it implement socialism by confining economic activity to the state or even the principles of the Islamic economy, which supports economic freedom and does not restrict private ownership to a specific scale of production or consumption. On the contrary, Islam encourages the growth of both public and private production and ownership. Maybe the hadith of the Prophet (PBUH) is a testament to this when he refused to set a fixed price ceiling after he was asked to intervene to stop the soaring prices in Medina, which were impacting production and consumption prices.

2-The Inconsistency of the Economic Policies of Successive Governments

Following up on the results of the economic performance of consecutive governments throughout the tenure of the revolution indicates the lack of integration between the long-term policies and objectives of the successive governments. Each government brings about policies which are different, or even contradictory, from the ones of the former government. Most of the governments always focused on the status quo instead of developing clear plans to achieve strategic economic objectives. These objectives include boosting and sustaining economic growth, and increasing the share of the Iranian citizen in economic growth by depending on reliable, not volatile, sources of growth such as oil. It also includes achieving certain limits on unemployment and inflation rates amid commitment to clear frameworks and restraints governing the government’s use of financial and monetary policies.

Pursuing temporary and interim financial and monetary policies was a common denominator among most governments. They did not consider the long-term impacts of their policies most of the time but instead focused on solving current problems.

In other words, most of the Iranian governments faced repeated financial deficits, especially at times when global oil prices dropped. They always pressured the Iranian Central Bank to either take out loans or print banknotes without restrictions. The Central Bank is supposed to maintain independence when it comes to running the monetary policy of the country away from political pressures.

The aforementioned attempted to find sources of finances for temporary financial crises regardless of the long-term ramifications. This led in the end to an increase in the expenditures of consecutive financial budgets and to the encouragement of consumption, not production. Iranian governments also did not develop reliable sources of income , such as taxes, let alone address the increasing budget deficit passing it on to successive governments. This is in addition to causing a hyper-growth of liquidity, which resulted in consecutive waves of inflation daunting Iranians for decades as we will attempt to explain in the following section.

III- Chronic Inflation and the Volatility of Economic Performance

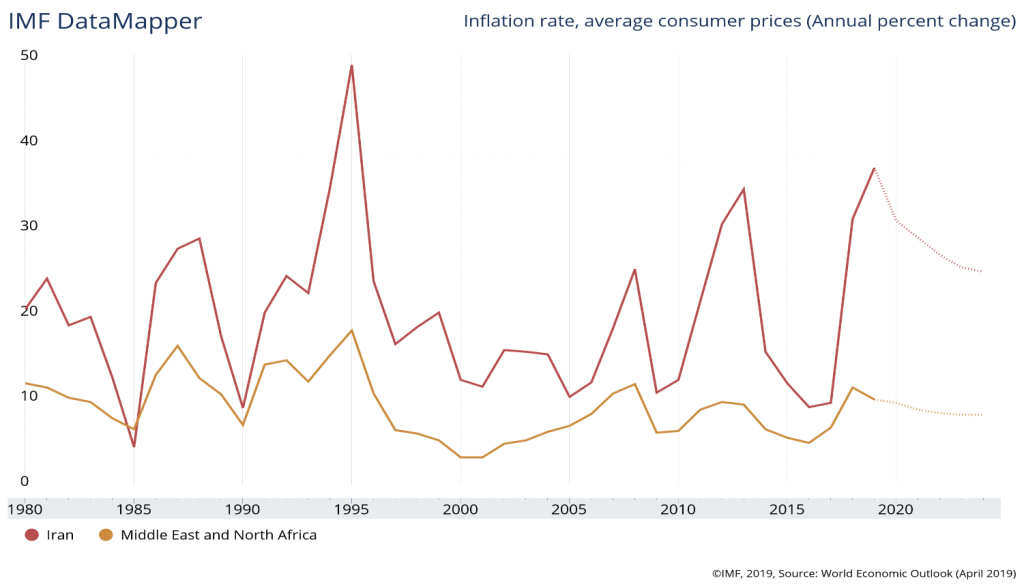

If we estimate average annual inflation during the last 30 years, we will find that it reaches about 21 percent annually,[22] which is a high rate compared to the average annual inflation of 8 percent for the countries of the Middle East and North Africa during the same period (see Figure No. 3). This has overburdened the majority of Iranian families due to the increased cost of living over the past three decades. In addition to the role of economic sanctions in increasing inflation, the nature of Iranian economic policies plays a significant role as we will explain below.

1- The Effect of Successive Economic Sanctions on the Currency’s Value and the Inflation Rate

Inflation is affected by several factors including: supply and demand for goods and services, the volume of liquidity, foreign exchange rates, the position of current balance and the monetary policies of the country. Most of these factors are negatively affected by Iran’s controversies with the international community and the subsequent series of sequential sanctions.[23] However, the recent sanctions were among those with the strongest impact in the depreciation of the local currency, which in turn affected inflation rates.

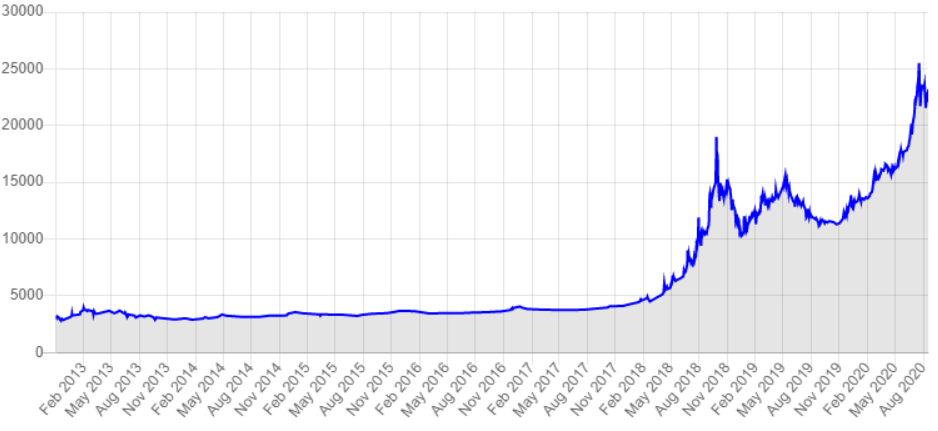

The rate of the local currency remained relatively stable for years, with direct support from the government. It only collapsed in the last three years (see Figure No. 2), following an increase in the budget deficit and the government’s inability to continue to support the currency.

In 2019, the consumer price index increased by 42 percent for the 12 month period ending on October 22 in comparison with last year’s corresponding period according to the Iranian Statistics Center. The goods and services Consumer Price Index increased by 61 percent during the same period.[24] It is well known that food is the largest component of the poorer classes’ expenditures. Therefore, any change in food prices will significantly affect their lives and standard of living.

Figure No. 2: The Exchange Rate for the US Dollar in the Free Market Against the Iranian Riyal (2013-2020)

Although the economic blockade and the repeated international sanctions Iran has experienced played a role in creating a state of chronic inflation, this did not exculpate successive governments from the responsibility to develop efficient policies reducing the recurrence of repeated sharp rises (1995, 2013, 2019) of prices over four decades. (See No. Figure 4).

Figure No. 3: Inflation Rates in Iran Compared to the Middle East and North Africa (1990-2020)

Iranian governments have excessively injected liquidity without controls that take into account the prevailing rates of economic growth, leading to uncontrolled inflationary waves. The Iranian people paid the price for it on the one hand, while the cost of total government spending increased on the other hand. This resulted in an increase in the budget deficit. The government thus runs in a vicious circle of inflation and a growing deficit, and then borrows to cover the deficit and so on. The next element will support further details about the role of the steady growth of liquidity in increasing the high inflation rates.

2- The Role of Sustained Liquidity Growth and the Preferences of the Iranian Investor in Fueling Inflation

The large gap between the growth of the volume of liquidities and the production or supply of goods and services is one of the decisive factors in the suffering of Iranian society because of the phenomenon of high inflation over 40 years. During the Ahmadinejad era, for example, some of his populist policies and slogans such as “bringing oil money to the dinner table of every Iranian” contributed to the excessive growth of liquidity, which fueled the growth of official inflation rates by more than 35 percent in 2013, in conjunction with the repercussions of sanctions, at the end of his second term.

Even with the different economic orientations pursued by President Hassan Rouhani than by his predecessor, Ahmadinejad, the problem of liquidity growth has arisen once again to counter the increasing financial deficit in the state budget. Liquidity has grown with an annual rate of 23 percent during the first four years since Rouhani took power in 2013[25] while the annual average growth of the gross domestic product was only 0.5 percent over same period, according to our calculations.[26] This has increased the already high inflation rate after the gap between the growth of liquidity and the economy became disproportionate.

Masoud Nili, an Iranian academic and former economic advisor to President Rouhani, believes that injecting hundreds of billions of dollars of oil money into the Iranian economy since the 1980s amounted to 200 billion dollars in some years and helped to improve peoples’ lives, in terms of health and education. The liquidity in the economy without parallel production growth and the government’s expenditures without creating sustainable resources have increased. Over time, government expenditures increased with the growth of population while government resources decreased, especially during the years when oil prices declined, and the budget deficit increased. The Iranian government used to turn to the Central Bank to borrow or print money.[27] Nevertheless, the growth of the deficit did not stop but rather continued and was accompanied by high inflation rates.

On the other hand, this significant gap between the liquidity and economic growth reflects the fragile role of the Iranian private sector as well as the failure of the country’s monetary management to contain inflation, boost private investment, and maintain the proper balance between demand and domestic production.

The nature of Iranian investors also played a decisive role in feeding the phenomenon of chronic inflation and weakening the supply and production side because the majority of Iranian investors prefer to work in the areas of quick profits,[28] probably to be able to pull the capital out of the country as quickly as possible in times of need which reflects weak confidence in the stability of the economy at the same time.

Therefore, we find that they prefer to work in sectors such as brokerage and services, and to stay away from productive projects that require economic stability and time to make profits. As a corollary to this trend, we notice a decrease in both the agriculture and manufacturing industries’ shares in the Iranian GDP in recent years from 26 percent in 2014 to about 21 percent through mid-2018.[29] In contrast, the contribution of the services sector increased from 51 percent to 54 percent during the same period, reaching 56 percent in 2017.

3-The Instability of Growth Rates and Economic Performance Indicators

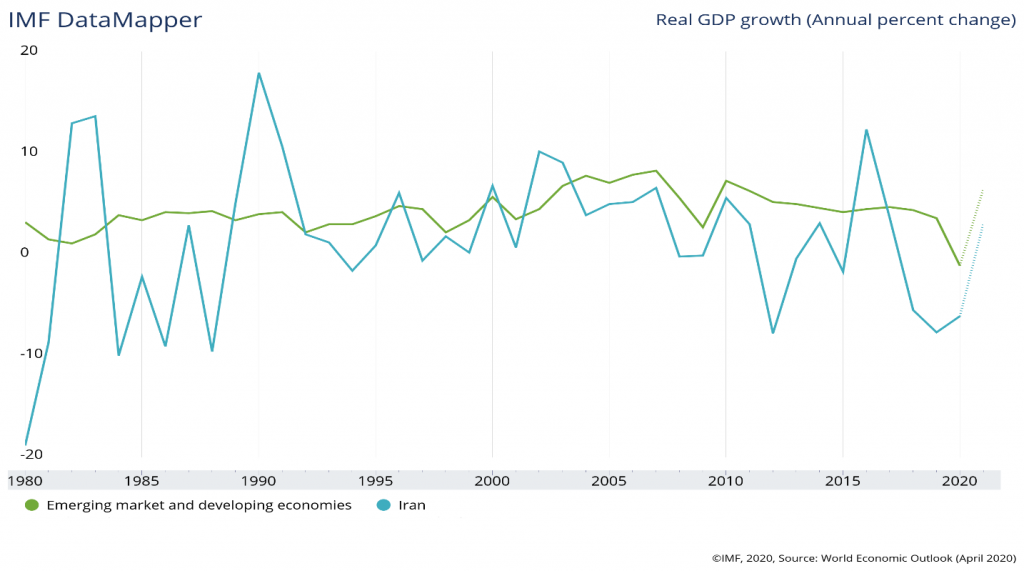

The real growth rate of the GDP of Iran’s economy is characterized by instability and sharp fluctuations between recovery at some points and sharp contraction at other times during the past four decades. In contrast, Iran’s GDP achieved high growth rates in the 1960s and 1970s. Growth has fluctuated between positive and negative over a range of 18 percent since 1980 (see Figure 5) due to a variety of factors:

A- The increased reliance on volatile primary sectors, whether fluctuation of volatile energy export prices or agricultural growth impacted by weather fluctuations. Agriculture in Iran depends heavily on rain rather than regularly irrigated agriculture .[30]

B- Geopolitical turbulences and external crises in which the Iranian regime has been involved, whether wars, fabricated armed conflicts, or international sanctions.

C- The enforced maintenance of a low exchange rate, which encouraged cheap imports, discouraged local production and increased unemployment rates.

Therefore, the annual average growth of Iran’s economy over 40 years were only (1.8 percent), which is lower than those of developing economies (4.5 percent)[31] and less than the average economic growth of regional countries that are similar to the size of Iran’s population such as Egypt (4.6 percent) and Turkey (4.2 percent), according to our calculations.[32] Unemployment rates were 35 percent of the labor force in the age group of 25-29 at time of the 2016/17 census.

In contrast, Iran achieved relatively high rates of economic growth in the 1960s and 1970s and was among the highest in the world (close to 10 percent), coinciding with an increase of GDP per capita and moderate rates of inflation.[33]

Not surprisingly, therefore, the Iranian GDP per capita of 7,936 US dollars at constant prices in 1978, one year before the revolution, was more than the per capita GDP in 2017, which amounted to 6,948 US dollars.[34]

Figure No. 4: Iran’s Real GDP and Developing Economies (1980-2020)

In the last two years, the Iranian economy has experienced strong shocks since the imposition of US sanctions in mid-2018 which led to:

A- Sharp contraction (-8 percent and -6 percent in 2019 and 2020 respectively according to IMF estimates). See Figure 4.

B- A sharp depreciation of the local currency in the free market from 4,300 tomans / dollar in January 2018 to 25,500 tomans as the maximum price in mid-July 2020.

C- The flare-ups of inflation to nearly 50 percent, according to official statistics.

D- The increasing budget deficit and withdrawal from the sovereign wealth fund.

E- The flight of foreign investment and the increase in unemployment.

F- The synchronization of US sanctions with the consequences of the spread of the Coronavirus since the beginning of 2020, which has adversely affected production, tourism activities, services, and internal and external trade. The current balance shifted to a deficit of 1.8 percent[35] of GDP.

With these grinding economic conditions, there is a positive population growth rate of 1.5 percent annually, which requires parallel economic growth to provide job opportunities and the necessities of life at reasonable prices. However, this modest positive growth has been missing since 2019.

Overall, the instability of real GDP growth, imbalance in production structures and chronic inflation are phenomena that have affected the Iranian economy for decades. They did and still constitute an obstacle to the happiness and well-being of the Iranian citizen and the realization of desired economic development. These phenomena, particularly chronic inflation, became a cause of widening poverty in the country and the reduction of the size of the middle class, as well as decreased purchasing power for the public with fixed and limited incomes which deepened the gap between social classes.

IV- The Imbalance of Public Budget Structures

The Iranian budget structure is characterized by basic imbalances. These imbalances can be described by concentrating on two issues: first, the absence of stable and sustainable sources of public revenues and the excessive dependence on oil to drive growth; second, the sustained trend towards increasing expenditures by relying on means of financing that have negative economic consequences, either usually leading to an increase in the inflation rate or affecting local investments and the volume of production. We will detail this further below:

1- Excessive Dependence on Oil to Drive Growth

Iran has primarily depended on oil to achieve two goals: driving economic growth in general and financing the government’s budget in particular. This excessive dependence caused an imbalance in the outcomes of both goals because oil revenues are not only variable based on oil’s unstable price in international markets, but also because revenues can be interrupted suddenly when Iran’s relations with the international community are strained and its oil exports are banned, as happened in 2012 and 2018 and continues to this day. As result, this hinders the implementation of development plans in the annual budget.

During the last seven years, the dependence of Iranian budget revenues on oil ranged between 33 percent to nearly 50 percent[36] of total budget revenues, tailored to the needs of each year. Sometimes governments have increased dependence on oil even greater than those rates when other revenues decrease, exposing the general budget to further deficit in cases where oil prices dropped less than what the government expected. However, the dependence on taxes was between 37 percent to 46 percent during the same time period.

2- Weak Tax Revenues and Debt Accumulation

Tax revenues are one of the important sources to fund the public expenditures of any country. However, they only represent about 33 percent of what the Iranian general budget actually needs if they are fully collected, which is not usually the case, due to the prevalence of tax evasion and exemptions. Therefore, the ratio of taxes to GDP was only 7.4 percent in 2009, according to the most recent World Bank data,[37] which is a modest rate compared to global and regional rates.

In the 1399 Solar Hijri budget (March 2020-March 2021), the share of taxes was 198,272 billion tomans (about $47 billion at the official exchange rate), or 33.2 percent of the total revenues of that budget. In the previous budget, the share of tax was 32.7 percent.[38]

Owing to basic obligations of the government that must be paid such as salaries, pensions, and operating costs of facilities, it was required to provide financing for these increased expenses every year for the increased prices. Therefore, it resorted to financing methods such as withdrawing from the sovereign wealth fund, printing money, or borrowing from pension funds and local banks or all of the above.

Nevertheless, these measures were not enough to reduce the deficit, but rather accumulated debts and their associated burdens year after year. Worse still, they were directed towards consumption and operation, rather than towards production or development. Because of these policies, the total government debt to local banks reached $37 billion in February 2017,[39] and the Iranian budget deficit in 2019 was estimated between $24 billion to $36 billion.[40]

The government could face the problem of lack of budget resources and the accumulation of debts by reducing tax evasion that the Iranian Parliament’s Plan and Budget Committee estimated at $9.5 billion annually[41] or tax arrears to public companies estimated at between $ 7-17 billion.[42] [43] Those lost billions are missed development opportunities that ordinary Iranians did not benefit from.

3-Exceptional Fiscal Measures for the 2019 and 2020 Budgets

A vivid example of the imbalance of the budget structure and its disruptive effects on economic development is what the Iranian government is currently experiencing in terms of a severe financial crisis, which began with the US embargo on Iranian oil exports in late 2018 leading to the collapse of oil exports along with the decline in basically weak tax revenues. This has severely embarrassed the government severely and pushed President Rouhani to call on Iranians to stand by the state and pay taxes. Otherwise, the government will not be able to prepare a budget for 2021.[44]

Therefore, with the approval of the Supreme Leader Khamenei, the government was forced to announce in July 2019 a plan[45] to reorganize the 2019/2020 budget , although it was already approved four months prior. The plan aims to reduce expenditures to the maximum extent and increase revenues whenever possible to fill the budget deficit through some means and methods we have already discussed. The plan included the following:

A- Privatization or the transfer of ownership of government assets amount to approximately 10 trillion tomans (2.4 billion dollars at the official exchange rate of 4,200)

B- Withdrawal of 50 percent of the foreign currency surplus in the current account estimated at 4.5 trillion tomans.

C- Selling government bonds, or what is called in Iran “Islamic sukok.”

D – Withdrawals from the sovereign wealth fund. The total value of items C and D is 62 trillion tomans ($14.7 billion).

The Iranian government was forced to implement additional extraordinary measures in November of the same year to face its financial crisis and lack of funding, such as eliminating fuel subsidies, which sparked popular protests in the same month.

Later, after the outbreak of the Coronavirus in the country in March 2020, the government sold shares of public companies on the stock exchange at reduced prices under the slogan “justice shares” in May 2020 because of its tight liquidity and the growing budget deficit estimated to reach more than $47 billion by the end of the fiscal year. In August 2020, the head of the Tehran Chamber of Commerce Masoud Khansari warned that the budget deficit for the current fiscal year ending in March 2021 could reach 200,000 billion tomans.

Overall, we can say that the imbalances of Iran’s budget have led to a set of accumulated risks as follows:

1- The Iranian state has become unable to frequently fulfill its basic and operational roles, not to mention its investment and development roles.

2 – The state treasury has a lot of money that could have been used for redistributing income and wealth, providing social and health services and improving public services.

3- The Iranian state was obliged to accumulate debts, withdraw liquidity from banks or public funds, and expose these institutions to financial crises and disrupt investment.

4- These problems affected the living conditions of the public, and the loss of the right of future generations to benefit from oil revenues and development.

Conclusion

It is true Iran has one of the largest economies in the Middle East in terms of the size of its GDP. It has various economic capabilities, but they are not optimally exploited. Its capabilities range from oil and gas, fertile agricultural soil, water resources and the diversity of its terrain and climate to some industrial legacies of the former regime. Not only this, but perhaps more importantly Iran has human resources, gifted minds and scholars scattered across Europe and the United States some of whom have won Nobel Prizes in various sciences. All of these elements would make Iranians among the richest peoples of the region after 40 years of a revolution that propagates ambitions and populist slogans.

The Iranian revolution was able to record some achievements at the social level including for the disadvantaged and rural classes and an expansion in the delivery of basic services such as electricity, water and education to the destitute countryside even if these achievements were linked to the years when oil prices were high in the 1980s. On the other hand, there were no clear plans to achieve a comprehensive development of the economy that would achieve stability and sustainability of economic growth, and which would improve the quality of life and increase the income of the Iranian public with every generation. Instead, Iranians have become prey to steadily increasing prices and high unemployment, especially among university students and youth, and the prevalence of poverty within society which increases security, psychological and societal problems including divorce, crime, and addiction.

We have seen how a set of radical obstacles have played a major role in hindering the development of the Iranian economy and society over four decades. Some of these obstacles have been entrenched since the Supreme Leader Ayatollah Khomeini laid the foundations of the new republic, while some have arisen when they found the appropriate environment for growth. The effects of some of these obstacles and distortions are still going on to this day to a large extent. It turns out that having economic sanctions imposed on the Iranian regime is not the only obstacle to achieving the revival the Iranian people sought. Therefore, lifting these sanctions will not change many of the economic distortions that have accumulated for a long time and which need to be eradicated.

The solution to these structural distortions depends on acknowledging their existence, defining them, and then developing long-term strategic plans to confront them rather than seeking change only to a limited extent. In addition, it is necessary to define a clear and realistic economic model that brings the Iranian economy out of its long isolation. This requires an awareness of the importance of integration into the international community, peaceful coexistence with surrounding neighbors, benefiting from international trade opportunities, stripping away the country’s economic interests from the political goals or ideological ambitions of the regime, focusing on mobilizing all financial resources at home to reform the distortions of the economy, eradicating the most important irritants of the Iranian citizen such as inflation and unemployment, and parallel work to reduce increasing poverty and the gap between social classes.

At the present time, both the Iranian economy and society are paying a heavy price for the accumulation of structural imbalances and international isolation, as we have explained in this study. They barely emerge from one crisis before entering another crisis. Therefore, both the Iranian economy and society have not yet recovered from the effects of the US sanctions two years ago. They are also afflicted with a health crisis with the outbreak of the Coronavirus in the country which will have negative effects on economic growth until the end of the current calendar year and which may last until the middle of next year if the US sanctions continue.

These difficult conditions will serve as a further noose in the future on the financial position of the state budget as well as on the regime’s supportive pillars. As evidence of this, the more crises that arise – whether economic or non-economic – the more the suffering of the Iranian people increases. They also reveal some of the existing imbalances and insufficient ways to deal with them that are often far from the reality and aspirations of Iranian society which is overwhelmingly comprised of young people that are familiar with the developments of the world despite the restrictions imposed.

Therefore, rethinking many intellectual or ideological constants that have hindered economic development over the past four decades and imposed isolation on the country, and the nature of the economic policies and trends pursued, is an essential requirement for Iran decisionmakers to take seriously before the situation gets out of control. Every era has different circumstances than previous ones which require a great deal of flexibility and good management of the country’s various capabilities to serve the public. Otherwise, the wait for the economic revival that Iranians are awaiting will be long-lasting even if all sanctions against their country’s economy are lifted.

[1] Djavad Salehi-Isfahani, “Iran’s Economy 40 Years After the Islamic Revolution,” Brookings, March 14, 2019, accessed November 5, 2019, https://brook.gs/3b9dcLA

[2] Jawad Kazem Hamid, “Economic Development in Islamic Visions with Reference to the Experience of the Islamic Republic in Iran,” Journal of Iranian Studies, no. 10-1 (September 2009): 109.

[3] Data are in constant 2010 US dollars. For more details, see: “Iran: GDP per Capita, Constant Dollars,” the Global Economy.com, accessed April 21, 2020, https://bit.ly/2WGGnSl

[4] “Iran Population Live 2020,” World Meters.Info, accessed April 21, 2020, https://bit.ly/2PU290P

[5] * A research paper, entitled “The Structural Imbalances in Iran’s Economy” written by Nabil Jafaar Reza in 1990 published by University of Basra in Iraq,” discusses the economic imbalances in general.

[6] Almaany Dictionary, accessed November 12, 2019, https://bit.ly/2WlQKte

[7] Almaany Dictionary, accessed November 12, 2019, https://bit.ly/2Wovfcr

[8] Nabil Jaafar Abdul Ridha, “Structural Imbalances in the Iranian Economy,” M.A. Thesis, Basra University, May 1990, 5-8.

[9] For more, see: Muhammad bin Saqr Alsulami, The Other Arab in Iranian Modern Mentality (Riyadh: International Institute for Iranian Studies, 1439 AH), 229.

[10] Majid Mohammadi, “What Are the Consequences of Islamist Enmity With the West?” Radio Farda, August 10, 2020, accessed June 17, 2020, https://bit.ly/3e8dYe0

[11] Evaleila Pesaran, Iran’s Struggle for Economic Independence: Reform and Counter-Reform in the Post-Revolutionary Era, trans. Subhi Magdy, (Cairo: Dar Al-Tanweer Publishing, 2011), 50.

[12] Ibid 64.

[13] For more on the history and developments of the oil industry in Iran, see: Yahya Daoud Abbas, Al-Baynah, “ Mukhtarat Iraniya (Iranian Selections), no. 81 (April 2007), Accessed December 10, 2019, https://bit.ly/2WrkcxQ.

[14] The Constitution of the Islamic Republic of Iran, promulgation by the Ministry of Islamic Guidance, with the assistance of the Preparatory Committee for the World Conference of Friday and Congregation Imams, Tehran, 1403 AH (1982), 42, 60 and 97.

[15] “ Iran (Islamic Republic of)’s Constitution of 1979 with Amendments through 1989,” Constitute Project.Org., 18, February 20, 2020, accessed September 9, 2020, http://bit.ly/2LkGKuu.

[16] Pesaran, Iran’s Struggle for Economic Independence. 180-181.

[17] Ibid., 219.

[18] “Iran Foreign Direct Investment: % of GDP (1997 – 2017 ),” CEIC Data, accessed February 16, 2020, https://bit.ly/3bNgvsb

[19] Ibid., 195- 196.

[20] Seyyed Ali Khamenei, “The General Policies Pertaining To Principle 44 Of The Constitution Of The Islamic Republic of Iran,” Iran Data Portal, accessed August 8, 2020, https://bit.ly/31DCD5i.

[21] See Khomeini’s will in Pesaran, Iran’s Struggle for Economic Independence, 103.

[22] The calculations of the researcher based on the data of the IMF report, World Economic Outlook (October 2019)، https://www.imf.org/

[23]* Since the Iranian revolution in 1979, Iran has encountered a series of successive economic sanctions, either unilateral sanctions by the United States of America that were initiated in 1979 and continue even today, UN sanctions since 2006 over the Iranian nuclear file, or European sanctions that were tightened in 2012 which had the most significant impact on the Iranian economy and society.

[24] “Iran’s Consumer Inflation at 42%,” Financial Tribune, October 25, 2019, accessed March 20, 2020, https://bit.ly/3bbFdlB

[25] “Liquidity in 97 Under Scrutiny: 5.46% Growth in Money Supply, + Table and Index,” Eghtesad News, July 8, 2019, accessed April 4, 2020, https://bit.ly/2yEKJMW.

[26] The calculations of the researcher based on the IMF report, World Economic Outlook (October 2019, accessed March 6, 2020.

[27] “Masoud Nili at the Monetary Policy and Banking Challenges Conference: The Long-term Performance of the Iranian Economy is Untenable,” Eghtesad News, April 21, 2019, December 5, 2020 https://bit.ly/2zaMJA8

[28] Hossein Mousavi , “The Iranian Economy: The Necessity of Structural Correction,” Shu‘un Al-Awsat (Middle East Affairs), no.104 (Fall 2001): 177.

[29] Central Bank of the Islamic Republic of Iran, Economic Trend Report No. 92, First Quarter 1397 (2018/2019), 2.

[30] For more on the structure of agriculture in Iran, see Ahmed Alsayed Alnajjar , Egypt, Iran and Turkey. Economic Reality and European Relations (Cairo: Al-Ahram Center for Political and Strategic Studies, 2003), 130-126.

[31] The calculations based on the IMF report, World Economic Outlook (April 2020), accessed April 6, 2020 https://www.imf.org/.

[32] The calculations based on the IMF report, World Economic Outlook (April 2020), accessed April 6, 2020 https://www.imf.org/.

[33] Shayerah Ilias, “Iran’s Economic Conditions: U.S. Policy Issues,” June 2010, Congressional Research Service, 3.

[34] Data reported in constant 2010 US dollars.

[35] “Political and Economic Outlook,” Economist Intelligence Unit (EIU),” Country Report (Iran), July 2020, 2.

[36] The calculations of the researcher based on the analysis of the general budget structures issued by the Central Bank of Iran, for 1391 Solar Hijri / 2012 AD to 1397 Solar Hijri / 2018 AD.

[37] “Tax revenue (% of GDP),” The World Bank, accessed August 19, 2020, https://bit.ly/3iXsBDc

[38] Researcher’s calculations are based on the Iranian budget data. For more, see: iranbudget.org

[39] “10 Active Crises Within the Iranian Economy,” August 16, 1398, accessed April 5, 2020, https://bit.ly/36TWPlg

[40] “Iran’s H1 Budget Deficit Tops $5.5b,” Financial Tribune, October 20, 2019, accessed March 1, 2020. https://bit.ly/2yhjtaR

[41] Ibid.

[42] The official exchange rate of the dollar against the toman is 4,200 tomans.

[43] “Liberation of the Oil Economy Depends on the Collection of Tax Dues,” October 23, 2019 accessed February 27, 2020, https://bit.ly/32LPBwg.

[44] Tharwat newspaper, October 23, 2019, no. 709. https://bit.ly/2L3QJEY

[45] “What’s Beyond the Iranian Budget Re-approval,” The International Institute for Iranian Studies (Rasanah), July 31, 2019, accessed June 16, 2020, https://bit.ly/2YDUKGK