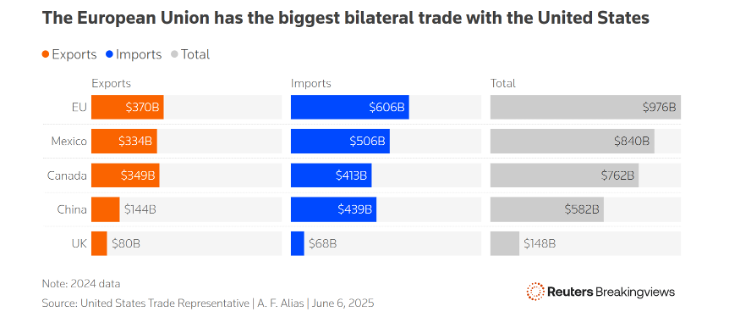

The United States under President Donald Trump has imposed tariffs such as a 10% “reciprocal” tariff on most EU imports, with threats to raise it to 50% by July 9, 2025, if no deal is reached. Existing tariffs include 25% on EU steel, aluminum and cars, which are part of a broader “America First” agenda to protect domestic industries and reduce the US trade deficit. In 2023, EU-US trade in goods was 851 billion euros, with a 157 billion euro EU surplus, a point of contention for the United States (see the below data for 2024).

The EU is adopting a “play it cool” strategy, focusing on negotiations rather than immediate retaliation. Trump’s trade policies reflect a pattern of leveraging US economic and geopolitical dominance to extract concessions. Unlike China, which retaliated forcefully against US tariffs, or Canada, which resisted through public solidarity, the EU cannot adopt a purely confrontational stance. Its fragmented political landscape, with some leaders sympathetic to Trump (e.g., Poland’s new president) and reliance on US support for Ukraine against Russia’s invasion limit its ability to escalate. Similarly, the EU differs from the UK, which quickly acquiesced to a US-favorable deal post-Brexit. The EU’s $236 billion goods trade surplus with the United States in 2024 gives it leverage, but not enough to overpower Trump’s “escalation dominance” through hard power, including potential cuts to Ukraine aid or NATO support.

EU Commission President Ursula von der Leyen played a key role in extending the negotiation deadline from June 1 to July 9, 2025, following a request during a call with Trump. This extension reflects the EU’s willingness to advance talks “swiftly and decisively,” as stated in an X post by von der Leyen. Brussels has also announced plans to impose tariffs on US goods worth nearly 100 billion euros ($113 billion) if negotiations fail to produce a deal. These measures cover only a third of the 379 billion euros’ worth of EU imports affected by Trump’s tariffs. This restraint signals a preference for dialogue over tit-for-tat escalation. Eventually, the EU is preparing economically, analyzing tariff impacts and building global coalitions to reduce US market dependence.

The United States’ closest allies are increasingly turning to one another to advance their interests, strengthening their ties as the Trump administration confronts them with tariffs and other disruptive measures affecting trade, diplomacy and defense. This emerging dynamic includes countries such as the UK, France, Canada and Japan — often described by international relations experts as “middle powers,” a term used to distinguish them from superpowers like the United States and China. Perhaps the most critical remaining challenge for EU countries in formulating a cohesive response lies in ensuring internal unity among member states. Maintaining a united front among EU member states is crucial, especially given political differences. Recent EU-wide political meetings, such as in Luxembourg in April 2025, aimed to emphasize an approach based on diplomacy and negotiations while showing readiness to initiate countermeasures if the trade talks failed

. This unity is vital to avoid bilateral deals that could undermine the EU’s collective bargaining power, a fear heightened post-Brexit.

According to EU data, US tariffs could reduce the EU’s GDP by 0.2%, with exports falling by 1.1 to 1.5% and the trade balance shrinking by 0.3% of GDP. Sectors like automobiles and pharmaceuticals face significant risks, potentially leading to job losses and reduced competitiveness. The EU aims to mitigate these impacts through diplomacy to avoid a trade war. Rather than engaging in immediate retaliation, the EU has focused on negotiation and delay tactics.

The EU’s approach includes several key components. Firstly, Brussels is assessing what a trade deal could involve, offering to increase purchases of US equipment and natural gas. Since Trump’s election, the EU has been trying to buy more US gas as part of a deal to avoid increased tariffs. This aligns with EU priorities, such as reducing reliance on Russian gas and bolstering defense, while potentially narrowing the US trade deficit.

Moreover, to reduce dependence on the US market, the EU is engaging with like-minded countries to reform the global trading system. This includes exploring open plurilateral agreements integrable into a reformed WTO framework. The EU is also proposing a development package for the WTO, including duty-free access for least-developed countries and economic integration of African countries, to foster global trade stability. The EU’s strategy also considers geopolitical factors, such as buying time to prepare a robust support package for Ukraine, given the risk that Trump might cut US aid. This long-game approach aims to ensure regional stability while navigating trade tensions.

US right-wing’s skepticism toward the EU could complicate negotiations, with some viewing the EU as more of a foe than a friend

. The outcome of the negotiations by July 9, 2025, will be pivotal. If successful, a deal could involve increased EU purchases of US goods, potentially easing tensions. However, failure could lead to escalated tariffs, deepening economic impacts on both sides. The EU’s ability to maintain unity and leverage its global alliances will be crucial in shaping the future of transatlantic trade relations and the broader global trade landscape.

If negotiations falter, the EU’s fallback is to endure short-term economic pressure while leveraging Trump’s vulnerabilities. This approach, though risky, reflects the EU’s recognition that it cannot match US hard power but can use its economic weight and diplomatic finesse to weather the storm. The EU’s response to US unilateral trade policies under Trump showcases a delicate balancing act. As trade talks progress, the EU’s ability to navigate Trump’s unpredictability while safeguarding its economic and geopolitical interests will test its unity and resilience in an era of global trade turbulence. The EU has adopted a measured, long-game approach to counter Trump’s unilateral trade policies, avoiding both escalation and capitulation.