The White House announced on Monday April 22, 2019 that US President Donald Trump has decided not to renew the waivers for the eight countries importing Iranian oil, which are due to expire in May 2019.

The White House added that the United States, Saudi Arabia, and the United Arab Emirates had agreed to ensure that global demand would be met as Iranian oil was excluded from the global oil market. This step is instrumental in the maximum pressure strategy that the United States has adopted towards Iran to change its behavior. The following sections look to answer: what is the nature and impact of Washington’s strategy on the Iranian energy sector? What will be the impact of canceling these waivers on Iran in the near future?

First: Pre-cancellation and More Restrictions on Iranian Oil Exports

When the United States announced the second round of its sanctions, it focused primarily on paralyzing the Iranian economy by imposing a blockade on Iran’s oil exports and restrictions on its financial transactions with other countries. If this strategy did not manage to drive Iranian oil exports to zero, the sanctions on Tehran’s financial transactions would minimize the revenues of its oil exports.

The United States had given waivers to eight countries to import Iranian oil to avoid a drastic impact on global oil prices, as well as to moderate the reaction of countries dependent on Iranian oil such as China which is considered an international rival of the United States. The US waivers aimed to give more time to countries relying on Iran’s oil to find alternative sources so that they would eventually comply with the US sanctions without placing further pressure on the global oil market which the United States and the West would not be able to withstand.

Over the last six months, the United States has focused on reaching consensus with the eight countries to which Washington granted waivers to import Iranian oil, in addition to Iraq to pressure them into halting Iranian oil imports or reducing them. Also, the United States tightened restrictions on Iran from collecting all of its oil revenues from these countries and limited their trading with Iran to basic goods and medicine.

In this context, the United States has obstructed many bilateral financial mechanisms, including the European Union’s (EU) mechanism, which has not been activated, to deprive Iran of benefiting from its oil revenues. Consequently, Iran’s internal crisis doubled; the government introduced austerity and fiscal policies to address the crisis of scarcity in its foreign currency reserves, since 80 percent of Iran’s income comes from oil revenues. The US Department of the Treasury has imposed numerous sanctions on Iranian banks and incorporated several Iranian entities and individuals on its sanctions list. Also, it has tracked networks in some countries that provide support to the Iranian government to circumvent US sanctions.

Moreover, the United States has put pressure on several of Iran’s neighbors and consulted with them to prevent Iran from smuggling its oil. The US Department of the Treasury has also put pressure on some Asian countries to adhere to the sanctions regime on Iranian oil exports, specifically Malaysia and Singapore that are in close proximity to the Straits of Malacca, from where Iran’s oil is smuggled to East Asian countries, or through indirect routes by Iran changing shipping companies and using ships carrying flags of other countries. This is in addition to other smuggling routes used by Iran, which the United States showed to these two countries to assist them in implementing its oil sanctions on Iran. Moreover, similar pressures have deprived Iranian oil tankers of passing through the Suez Canal towards Syria to support Bashar al-Assad.

In the past six months, the United States paved the way to not extend the waivers on Iran’s oil exports and to limit Iran’s access to oil revenues. It succeeded in curbing Iran’s ability to collect oil revenues, it cut off Iran’s access to huge amounts of oil revenues in foreign bank due to sanctions. Thus, the policy of preventing Iran from benefiting from its oil as a primary economic driver and the source of its essential national income constituted critical aspects of the maximum pressure strategy adopted by the Trump administration towards Iran. Also, the latest US decision will be an essential test for Trump’s strategy and Iran’s ability for confrontation with Washington.

Second: Repercussions of US Oil Pressures on Iran and its Circumvention Techniques

In early November 2018, when oil and financial sanctions came into force, 20 countries cut their imports of Iranian oil, and Iran’s oil exports dropped to half by the beginning of 2019. The US pressure contributed to reducing Iranian oil exports in May 2018 to 1.1 million barrels per day. Some oil and gas field development projects have been suspended. Besides, some petrochemical and renewable energy projects have been disrupted, and major international oil companies have withdrawn from the Iranian market.

Three countries granted sanctions exemptions – Greece, Taiwan and Italy, (later joined by Japan) – announced that they have already stopped importing Iranian oil in compliance with US sanctions due to the lack of guarantees ensuring the arrival of oil trucks before early May 2019, the deadline of the US sanctions waivers. India, for example, cut its imports by half, and Indian refineries have not yet issued their demands for May to Iran in anticipation of the US position on whether it extends the waivers or not. If all these countries committed to the sanctions, 75 percent of Iran’s current oil exports (1.1 million barrels) would stop.

The United States achieved its desired results through a careful policy aimed at maintaining balance and stability in the global oil market. It also prepared, in agreement with its regional allies (the Gulf states), to bridge the deficit caused following Iran leaving the global oil market. Saudi Arabia and the UAE promised to compensate for any drop in oil supply. Despite the slight rise in crude oil prices following the Trump administration’s announcement, which amounted to 2 percent, the US administration seems reassured that the market will not be affected by the reduction or Iranian oil exports falling to zero, so it decided not to extend the sanctions waivers.

Also, the special financial mechanisms that Iran tried to launch with some countries, including the proposed EU mechanism (SPV) that has not come into force yet and the proposed mechanism with Russia, China, and Turkey, as well as the INSTEX mechanism which the European Troika countries announced have all failed as well. They all seem useless, as their activities cannot exceed the ceiling imposed by US sanctions, they are limited, in the first phase, to humanitarian and medical equipment and do not include Iranian oil revenues.

Over the past few months, Iran has faced great difficulties in accomplishing its financial transactions with its partners, including collecting all of its oil revenues under the continuing US sanctions on its financial transactions. A member of the Economic Committee in the Iranian Parliament, Shehab Nadri confirmed that on April 20, 2019, “The Iranian economy receives only about half of its oil revenues.”

Although the price of Brent crude oil rose by 2 percent with the US announcement of its waivers cancellation, it seems to be in response to US reassurances due to its efforts in securing alternative oil supplies. This was revealed when the White House announced that the US agreed with Saudi Arabia and the UAE to cover the deficit caused after the suspension of Iranian oil exports.

Of course, all countries that insist on dealing with Iran will face effective US sanctions. The past months since the US withdrawal from the JCPOA has shown that companies and countries have no willingness to confront such sanctions and bear the losses of dealing with Iran, as well as the loss of the US market and the international financial facilities offered by the US-dominated SWIFT system.

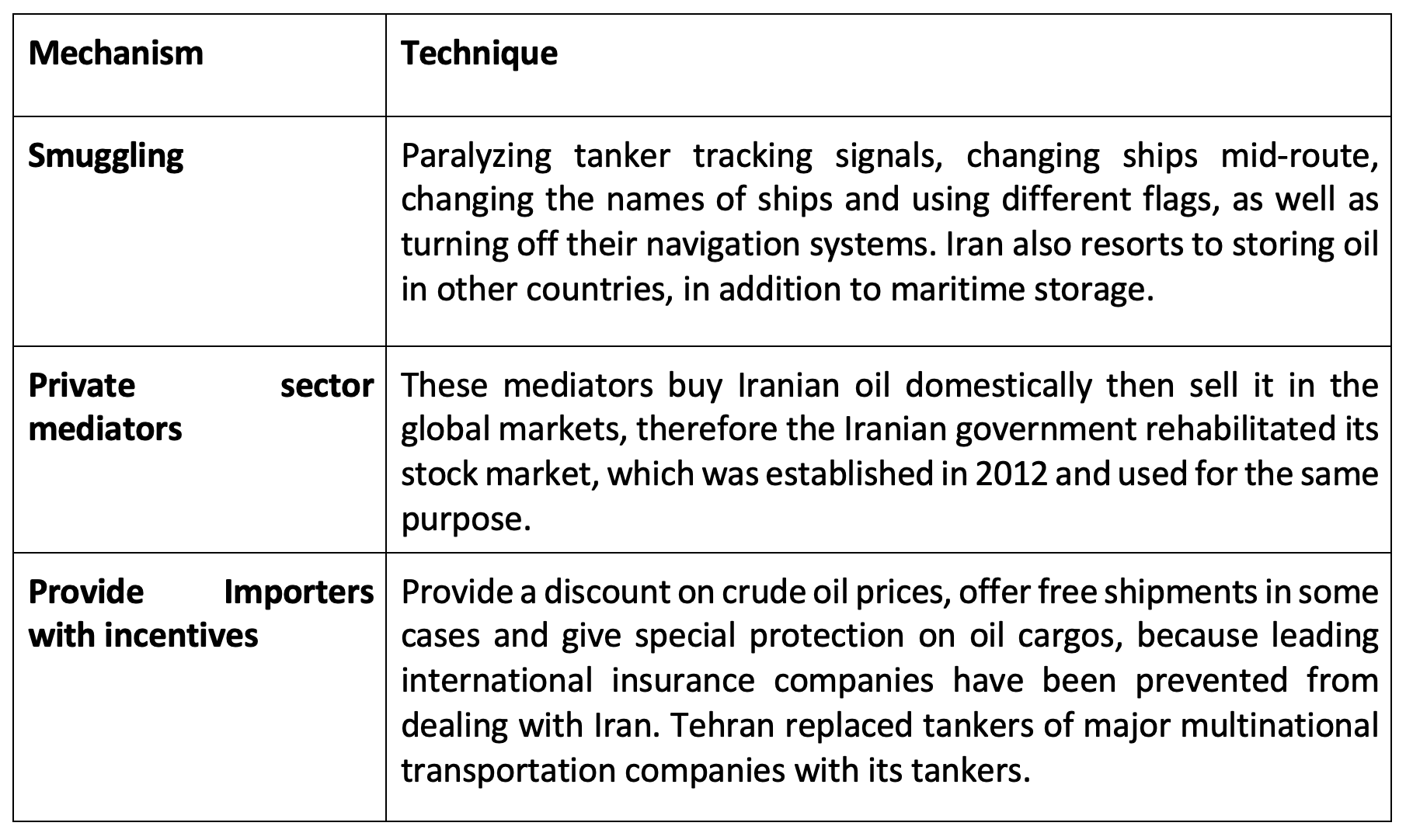

The Iranian government has adopted a hedging strategy to address any possible embargo on its oil exports, through a multi-pronged policy to resist the US driving its oil exports to zero, including closer cooperation with some neighboring countries to help it overcome the sanctions and to smuggle oil especially with Iraq— where Tehran enjoys military, political and economic influence. Opening borders with Iraq can offer an opportunity to help smuggle and trade oil between the two sides. The Iraqi government refuses to comply with US sanctions because the country relies on Iranian gas and electricity. Turkey also believes that it cannot do without Iranian oil in the current circumstances, so Ankara resorts to placing pressure on the United States in order to continue its waivers on Iranian oil.

Moreover, Iran invests in smuggling networks in the Caspian countries and in trading gas with oil in these countries. It also seizes the opportunity offered by some neighboring countries suffering from unrest like Afghanistan, to avoid oil or financial sanctions. Iran also persuades oil smugglers by offering competitive prices to facilitate smuggling and purchasing processes. However, the US decision is without a shadow of a doubt a card Washington can use to place further pressure on Tehran. In return, the Iranian government will face an escalating crisis at home. It will resort to using illegal routes to smuggle oil as well as collecting its oil revenues, most likely via international networks in neighboring countries and Russia.

Iranian Circumvention Techniques

Third: Challenges and Potentials

For its oil strategy, the United States needs to provide some exempted countries with alternative oil sources, especially those ready to use certain types of oil. They will keep Iran’s oil exports low and reduce oil revenues to its minimum rate for several months while maintaining stability in the global oil market if there is a serious intention in forcing Iran to make substantial concessions to the United States because high oil prices will compensate Iran for some of its losses from lower oil exports.

Some countries, specifically Turkey and Iraq, must be forced by intense pressure to convince them not to help Iran and not to confront US policy because they represent two vital elements for Iran’s strategy to circumvent US oil sanctions. The US Department of the Treasury revealed the significant role of Iranian money and oil smuggling networks in these two countries during the last phase.

Moreover, the United States is likely to complete the elements of its maximum pressure strategy and place further pressure on other parties to corner the Iranian government between making concessions or facing complete collapse.

There is no doubt that some of the eight countries will abide by the US decision to abolish the waivers. These countries include Taiwan, South Korea, and Japan. These countries have already reduced their imports of Iranian oil to a zero rate. They have strategic relationships with the United States and have complied with US sanctions on Iran before.

However, there is another category, although it was announced that its imports of Iranian oil have reached zero, these countries imported Iranian oil illegally, and their oil refineries are of an appropriate quality for Iranian oil. These countries are Italy and Greece.

China has adopted a policy of diversifying its oil imports. It has not complied with US oil sanctions against Iran. It also considered Trump’s policy and current sanctions outside the framework of international law. Therefore, it is not obligated to abide by the sanctions.

The neighboring countries, particularly Iraq and Turkey, have economic relations and large trade exchanges with Iran. There is considerable mutual dependence between the two countries and Tehran, particularly in the fields of energy and oil. The geographical proximity of these countries offers Iran an opportunity not just to smuggle their oil exports, but also to sponsor international networks to overcome the financial sanctions. They could thwart the policy of reducing oil revenues to zero that the United States seeks to achieve in the upcoming period. Iraq is more important than Turkey in this area because of the significant influence Iran possesses inside the country. There is no doubt that delegations from both countries arrived in the United States to pressure Washington to extend its waivers, especially as they will be fundamentally affected by this decision.

The Indian position is still suspended, as it can give up on its imports of Iranian oil, if there is a substitute for it, especially as its imports are suspended for the next month as it is awaiting the US position towards whether it extends the waivers or not. Some regional countries may cover its oil needs such as Saudi Arabia or the UAE, albeit India is also trying to persuade the United States to extend its waivers.

The United States may succeed in limiting Iranian oil exports to its lowest rate and the US administration’s officials who are responsible for the Iranian file have hinted towards this rather than driving Iranian exports to zero. This will be a starting point for a new phase of tightening sanctions on Iranian oil exports without destabilizing the oil market, or facing thorny disagreements with some international powers such as China and Russia on the Iranian file. Moreover, if pressures continue the Iranian government will be more confused and weaker, public discontent will increase following deteriorating living conditions and its inability to meet basic daily needs.

After all, not extending waivers to any country keeps all countries and entities under the influence of US sanctions. This may cause Iran heavy losses because it will be forced to sell its oil at low prices and subject to blackmail. Iran also may not be able to collect oil revenues except under the US sanctions system.

In a nutshell, the US decision to cancel waivers on Iranian oil exports is a crucial step to complete the US maximum pressure strategy. It also indicates the US intention to force Iran to engage in a serious negotiation process before Tehran faces further escalation. A variation in tactics by the US may make this strategy more effective in achieving sought after objectives.