Rouhani introduced the draft budget for the coming year 2020/2021 to the Parliament for debate and to vote on whether to adopt or amend it. Rouhani called it the budget of resilience in light of the US maximum pressure strategy against Iran. This admission reflects the difficult financial situation of the government this year, which will drag on till the coming year. It also reflects the strong impact US sanctions have had on the Iranian economy even if measures were introduced to circumvent sanctions on oil exports and trade dealings with the aid of the IRGC and the Quds Force as well as smuggling networks which the government operates under such circumstances.

Iran’s Parliament is expected to discuss the budget in the coming weeks and vote on whether to accept it or amend some items as was the case with the last budget. This report will focus on discussing the main characteristics of the draft budget for the coming year. In addition, forecasts and reactions of the Parliament and the supreme leader will be discussed in light of the current US sanctions.

I. The Main Characteristics of the 2020 Draft Budget in Seven Points:

1- Misleading Statements on Iran’s Positive Economic Growth Which Reflects the Enormity of the Economic Crisis

While introducing the draft budget to the Iranian Parliament, Rouhani spoke of ‘positive growth indicators’ being shown by the Iranian economy. On the contrary, the International Monetary Fund’s data reveals a negative growth of 9.5 percent. In light of this, what positive economic growth is Rouhani referring to? In order to save face and instill hope, Rouhani decided to speak of the positive economic growth being shown within small-scale economic sectors. For example, he spoke of the growth in the production of the Karun oil field. But he ignored the decline in the overall oil production in the country. He also spoke of the growth in wheat crops in an Iranian district instead of speaking of the decline witnessed in the agricultural sector as a whole. This false impression was also given by Rouhani concerning the industrial sector and other sectors in order to avoid speaking of the massive economic downturn which every sector in the economy has been suffering since the imposition of US sanctions, especially on Iran’s energy, and industrial sectors as well as on its banking and foreign trade services.

2- The Real Value of a Modest and Deflationary Budget

The draft budget for next year is less in real value than the budget for the current fiscal year (March 2019 – March 2020), if we take into account the high rate of inflation (41 percent) and the exchange rate on the free market (13,000 tomans per dollar) even if the proposed budget is slightly higher than the budget of the current year in nominal or numerical terms. Thus, the volume of this budget is at least 14 percent less in terms of its real value in light of market prices.

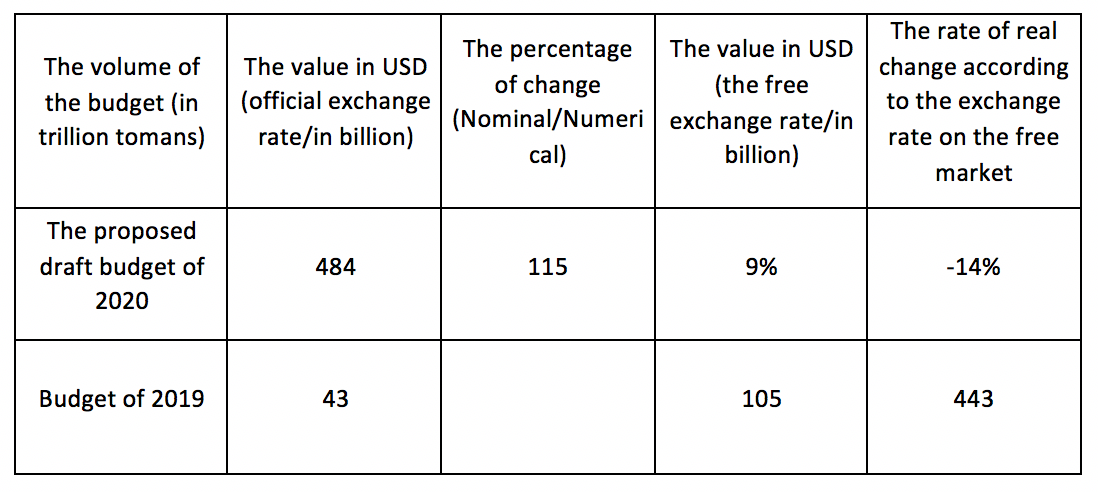

Table 1: Comparison Between the Volume of the Budget and Its Real Value for 2019 and 2020

Source: ©2019 Rasanah IIIS

The proposed government budget volume is 484 trillion tomans (115 billion tomans at the official exchange rate of 4,200 tomans per dollar), compared to the current budget volume of 478 trillion tomans ($115 billion at the same exchange rate). The value of the proposed budget at the current exchange rate of the free market is $37 billion (at a price of 13,000 tomans per dollar). It was equivalent to about $43 billion at the prevailing exchange rate at the time of introducing the current budget last year (11,000 tomans per dollar).

This means that the budget has decreased in its real value if we take the exchange rate into account, which means that it is a deflationary budget because the government has had to lower its expenditures significantly due to the decline in revenues and its lack of confidence in increasing revenues over the next year. The budget is not commensurate with Iran’s growing population and its rising needs as well as inflationary pressures.

3- Failure to make Good on the Promise to End the Contribution of Oil to the Budget

The Rouhani government has not been able to fulfill the promise it made during the last period to end the contribution of oil revenues to the budget. More surprisingly, for the second time, the government still expects an unrealistic volume of oil exports, as it did with the current budget. In order to save face, Rouhani pledged to allocate oil revenues for investment in urban infrastructure as if development expenditure is somehow detached from the budget’s overall considerations.

The draft budget expects oil and gas exports as well as their derivatives to contribute 77.7 trillion tomans ($18.5 billion at the official exchange rate, or 14 percent of the total budget), after giving the National Development Fund 20 percent of total energy sales instead of 36 percent. The Iranians expect to export between 800,000 to 1 million barrels per day in 2020, while independent sources reveal that last November oil exports reached nearly 200,000 barrels of oil. It is worth noting that this year’s budget is expecting to export 1.5 million barrels per day.

Therefore, it seems that the government will commit the same mistake and aggravate its financial deficit by miscalculating future oil export projections unless an agreement with the United States is reached, which is not on the cards given the position of the current US administration towards Iran.

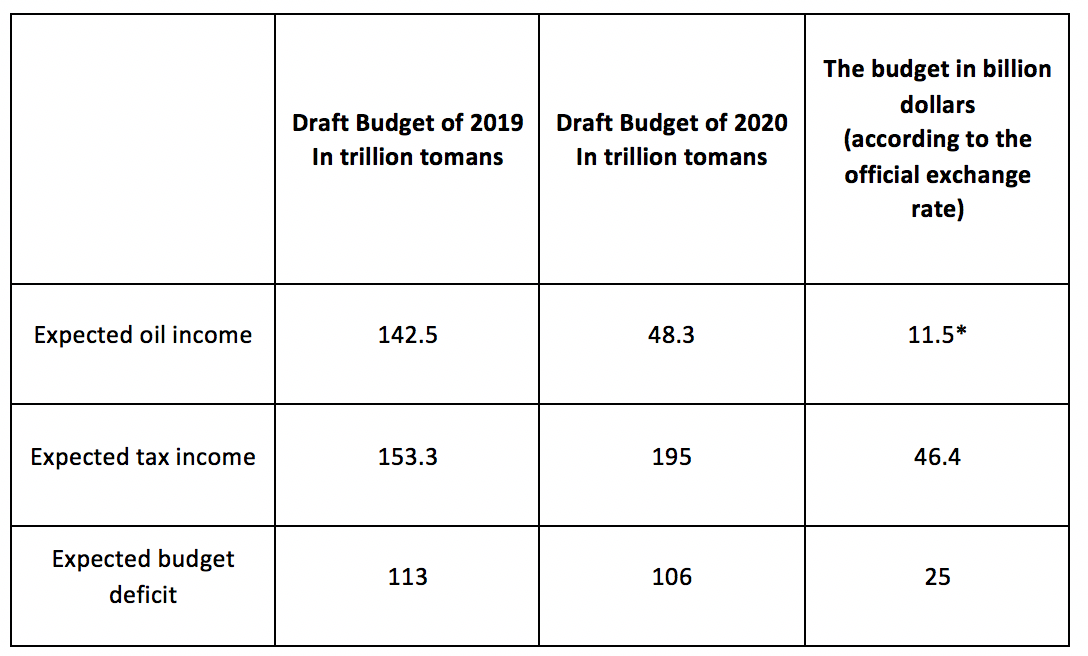

Table 2: Comparison Between the Draft Budget of 2019 and 2020

*The contribution of oil exports to the budget without taking from the National Development Fund

Source: ©2019 Rasanah IIIS

4- The Government’s Desire to Maintain the Day-to-day Routine in the Country and Allay Public Anger

The new draft budget proposes a 15 percent allowance for public sector employees, military officials, and retirees despite the financial crisis which the government is experiencing. In parallel, the government is attempting to appease the people who are not working in the public sector by promising to improve their living conditions and keep the dollar exchange rate as it is at 4,200 tomans to ease the import of basic commodities such as food and medicine.

The Iranian government fears that there will be a disruption in public sector entities run by the state or that there will be worker strikes. Therefore, it is attempting to contain popular anger after the wave of protests which hit the country after the government raised the price of gasoline. However, the pledge to raise worker allowances by 15 percent remains less than the inflation rate which was 41 percent in the past 12 months ending in November. The allowance is even less than that of this year’s budget, which is 20 percent.

5- Increasing Taxes Amid Tax Exemptions for Religious and Military Entities

The government of Rouhani expected that its income tax would increase by 30 percent compared to the current budget to reach 195 trillion tomans ($46.4 billion according to the official exchange rate) in a bid to plug the gap created by the decline in oil revenues. But practically, this expectation is not realistic at the time being for two reasons:

First: It is not possible to expect increased tax collection during an economic recession when there is a decline in business, sales, and trade, as well as a decline in purchasing power. Therefore, this expectation goes against basic economics. If the burden increases on taxpayers, the economic recession will be aggravated according to the previous experience of the countries of the Organization for Economic Co‑operation and Development.

Second: The massive tax evasion coupled with huge tax exemptions for the institutions affiliated with the armed forces and religious establishments. This includes the economic firms affiliated with the army and the IRGC, such as the Headquarters for Executing the Order of the Imam and Astan Quds Razavi.

Therefore, at the end of next year, tax receipts may be below the estimates of the government, which will give rise to a financial crisis. This may compel the government to take negative decisions that impact livelihoods, as it did by tripling gasoline prices. This once again jeopardizes the government’s stability.

6- The Increase in the Development Budget Could Mitigate the Economic Recession if Funding is Available

The government has proposed allocating oil revenues (14 percent of the budget which is equivalent to $18 billion) to urban development and infrastructure in addition to pumping investment by government companies which is more than twofold the previous number in the same field. If the government succeeds in pumping these funds, it will gradually help to ease the recession, provided that government companies can provide this large amount of money for investment, as well as the government receiving the oil revenues that it has projected. This is highly unlikely in light of the oil blockade, economic recession and the liquidity shortage that government companies are facing.

7- A Slight Increase in the Security and Defense Budget as well as for Religious Entities Active Overseas

The government proposed a slight increase in the budgetary allocation for defense and security entities. A figure of less than $300 million, the lion’s share of it is allocated to the IRGC as an attempt to appease it and pass the budget. The total defense and security budget amounted to about $16.5 billion at the official exchange rate (approximately $5 billion worth at the free exchange rate). The share of the IRGC is about $5 billion at the official exchange rate of the dollar, and the Iranian army’s share is about $3 billion. There have been increases, however less than the aforementioned, for both the internal security forces and the Basij. This is in addition to allocating €2 billion from the National Development Fund to the military defense budget, the biggest part of it usually goes to the IRGC.

The religious entities, especially those working outside Iran, saw their budgets increase slightly. The increased allocations were given to entities in charge of exporting the revolution overseas such as the Al-Mustafa International University which had its budget allocation increased to $25 million, compared to $24 million last year. Also, the Islamic Culture and Relations Organization and Ahl Al-Bayt World Assembly had their budgetary allocations increased.

However, the budgetary allocations of some religious entities inside Iran have been reduced. The Supreme Council of Religious Seminaries has had its allocation cut by $5 million and the Islamic Conveying Institution also has had its budget cut.

This may prompt the conservatives to protest during the debate on the draft budget in the Iranian Parliament.

8- Funding by Creating a Deficit and Taking Loans Without Taking the Consequences Into Account

The approach the government has been pursuing when it comes to dealing with the budget in the past days reveals the expected future inflationary consequences. For funding the budget, the government has depended on increasing monetary liquidity and borrowing from domestic banks without creating genuine sources of funding or addressing existing production problems. This will cause high inflation and fluctuations in the exchange rate will continue.

The level of the budget deficit is estimated at $25 billion. In reality, the deficit is bigger than this estimate. In the draft budget, the government depends on financing the deficit with a $5 billion loan from Russia, withdrawing €3.5 billion from the National Development Fund, issuing Islamic bonds (local borrowing) and selling government assets. The most dangerous among these financing tools, which is not announced transparently – is the printing of money to finance the deficit as usual. It will appear in sharp price hikes, which is a highly likely scenario in the future.

II. How is Parliament Expected to React to the Next Budget Bill?

The Iranian Parliament is not expected to pass the current draft budget without asking for amendments to some of its sensitive items, especially those related to defense budgets and religious institutions. This is in addition to the items that may affect the standard of living of citizens during the next year and foment public tension and protests. The Parliament may amend the items related to increasing taxes, request an increase in the annual allowance for employees to cope with the rate of inflation, or ask for an increase in the budgets of some religious and military institutions while reducing the budget of other entities in order to reduce the budget deficit and provide alternative financial sources for their funding. The Parliament may also object specifically to foreign borrowing.

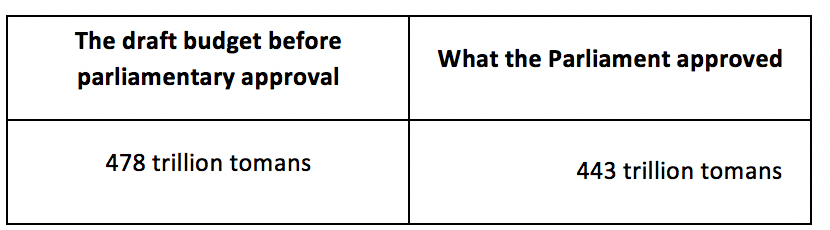

In the past year, the Iranian Parliament and supreme leader refused to pass the budget three times and the government was forced to reduce it slightly.

- The Parliament and supreme leader rejected or demanded the amendment of the following:

- The Parliament rejected the government’s increase in gasoline prices and asked for a delay in the decision.

- The supreme leader refused to grant the government the full 36 percent oil revenue share which is deposited in the National Development Fund but agreed to grant a smaller percentage of it.

- The government was asked to cut expenditures considering the current circumstances

- The government was asked to search for alternative financing sources and activate the resistance economy

- The government was asked to increase the armament budget from the National Development Fund.

The government was obligated to make the above amendments and remove the items rejected by the supreme leader and Parliament. The budget was finally approved in March 2019 after reducing its volume from 478 trillion tomans to 443 trillion tomans.

Table 3: The Current Draft Budget 2019

Source: ©2019 Rasanah IIIS

As a result of the anger on the Iranian street at the time following the increase in gasoline prices, it is expected that the Iranian Parliament will protest any decision which foments such discontent. The Parliament may also block the increase in taxes unless it is made sure that they do not affect living conditions. The Parliament may also call for tying allowances to the rate of inflation or increasing it at least in light of the huge price hikes this year.

The Parliament may call on the government to make good on its promise to end the contribution of oil to the budget or call for a further reduction. The conservatives will demand an increase in the budgetary allocations of the religious entities that have had their budgets reduced.

Finally, the budget is not approved unless it is made sure that it is committed to the orders and directives of the supreme leader, who pays huge attention to the military budget, especially that of the IRGC. The supreme leader spends on it exclusively from the National Development Fund from which there is no withdrawal without the supreme leader’s consent. This is in addition to the independent IRGC budget which comes from the institutions, and firms it owns which are beyond parliamentary and government control. It has benefited from the economic blockade. Its trade and activities continue to boom and its rivals on the domestic market become fewer and its activists overseas get a boost. On the contrary, the government’s financial situation gets worse due to the ongoing sanctions, which is reflected in the deflationary budget for the coming year and the government’s withdrawal from some of its historic roles such as providing subsidies. This was evident with the government tripling gasoline prices recently. If this continues in the future, popular anger and discontent will rise, and clashes between society, the government and the “reformists” on the one hand and the IRGC and conservatives on the other hand will escalate as the latter are to blame for the deteriorating financial situation of the current government in particular and the economy in general. This is in addition to Iran’s differences with the United States and the West not being settled, which has impacted the image of the “reformist” movement and its popularity among the people in addition to damaging the economy in its entirety.