Introduction

Energy prices have sharply increased overnight — recording new highs following the Russian invasion of Ukraine on February 24, 2022. Markets across the world, whether energy markets, stock markets or even basic food markets, were thrown into disarray. Most of the world’s economies were impacted by the sudden spike in energy prices. On the other side, nonetheless, there are countries that will attempt to take advantage of the crisis.

At the political level, it is expected that the surge in energy prices will have several implications for countries around the world. This could also play an influential role in shaping alliances and balances among several countries.

The Impact of the Russian-Ukrainian War on Energy Prices

The recent geopolitical tensions brought about by the Russian-Ukrainian war have sent oil and gas prices soaring to unprecedented levels; more than the levels they reached a decade ago following the uprisings of the so-called “Arab Spring” which broke out in 2011.

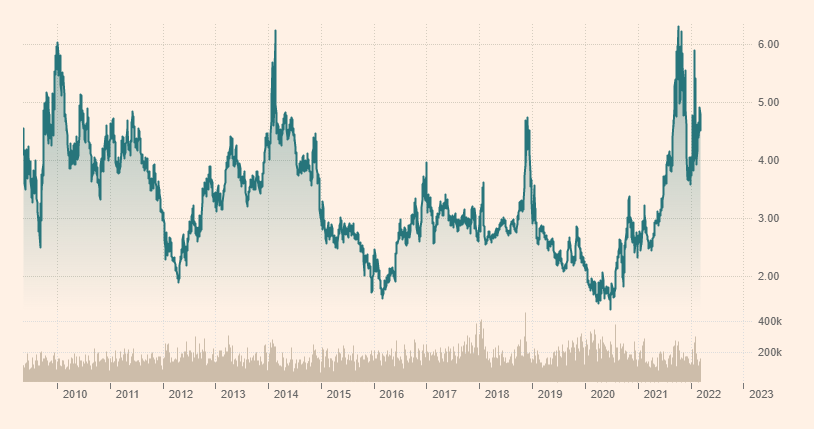

Days after the Russian-Ukrainian war broke out, the price of a barrel of oil (or a barrel of Brent crude oil) surpassed $120 this March — up more than 50 percent from the price posted in November 2021 (see Figure 1). As for natural gas, prices have seen sharp fluctuations throughout 2021 (see Figure 2). Prices remain high, given the significance of Russian gas for Europe and the impact of the war on disrupting supplies to the continent. The Nord Stream 2 gas pipeline extending to Europe has been suspended.

Figure 1: Oil Prices from 2011 to March 2022

Figure 2: Gas Prices from 2010 to March 2022

Opportunities and Gains for Energy Exporters

No doubt, oil and gas producers benefit from the spike in energy prices. Energy exports account for a huge portion of their revenues and national budget — coming years after a steady decline in the price of a barrel of oil. The Organization of the Petroleum Exporting Countries (OPEC) is the biggest and most important bloc for oil and gas condensate producers in the world. It comprises the following countries: Saudi Arabia, Algeria, Iraq, Iran, Venezuela, Kuwait, Libya, the UAE, Nigeria, Gabon, Angola, Congo, and Equatorial Guinea. There is also OPEC Plus, which includes 10 non-OPEC countries such as Russia, Azerbaijan, Kazakhstan, Bahrain, Malaysia, and Oman.

The current rise in oil prices helps in unifying the political and economic position of oil producers toward the West. OPEC Plus has agreed to a unified position so far, refusing to massively and swiftly pump large quantities of oil to significantly bring down oil prices. They have remained committed to the plan to gradually increase production which was agreed last year in line with OPEC Plus objectives.

As for the surge in gas prices, this benefits the world’s primary exporters such as Russia, which still exports gas to Europe, and other countries like Qatar, the United States and Algeria. Moreover, the countries that have recently discovered large deposits of gas in the Mediterranean basin will experience a surge in demand. The Gulf states are to draw up plans so that their large gas reserves reap them significant benefits in the future.

Iran is also among those countries which are taking advantage of the surge in energy prices. Iran has experienced a shortfall in its sources of revenues over the past three years. Its revenues largely depend on oil exports. But because of the trade and oil sanctions imposed on it by the United States, oil exports declined by more than 60 percent in comparison to the export percentage prior to the sanctions. Iranian exports were limited to certain countries, primarily China. Therefore, it is expected that the rise in oil and gas prices will benefit Iran in several ways:

- Boosting its financial revenues: The price of a barrel of oil stands at $120, nearly double the estimated price for the coming Iranian fiscal year 1401 HS ($60 per barrel). Although Iran drafted its national budget in light of expecting the US sanctions to continue and to export small quantities of oil, it began to adjust its expectations by increasing its oil exports following the Russian-Ukrainian war. Iran also raised its expected price because of the war’s ramifications on global prices.

- Taking advantage of the global market’s thirst for oil: By increasing the quantity of oil it exports abroad, even in the context of continued US sanctions. Iran is offering price discounts to many companies in order to entice them — and even to some governments — so that they pay no heed to US sanctions. This will ensure supplies remain stable and below the market price, especially for energy-intensive countries.

- Oil benefits do not apply to gas: Though Iran possesses massive reserves of gas, its exports are limited, currently going mainly to Iraq. It even imports gas from Turkmenistan to make up for the shortfall in its northern regions due to its intensive domestic gas consumption and it lacks the necessary infrastructure and investment to extract and export more gas. But in the long run, things could change, as could European approaches toward Russia.

- Energy prices acting as a lever in favor of Iran amid the nuclear deal talks: Lifting the sanctions imposed on Iran’s oil sector will increase global supply and contribute to lowering soaring prices. This is because the gap between global production and consumption is estimated at 900,000 barrels per day, according to the International Energy Agency (IEA) last January. It is expected that lifting the sanctions on oil exports will increase Iranian exports by nearly 1 million barrels per day.

Venezuela — buckling under the weight of US sanctions like Iran — will significantly benefit from presently soaring oil prices. There is a likelihood that it will have sanctions eased — specifically those on its oil sector — after a US delegation visited Venezuela some days ago. Venezuelan President Nicolas Maduro thereafter stated that there is a possibility that oil production in the country will be increased to 1 million additional barrels per day on the condition that Washington recognizes his government. Venezuela presently produces 1 million barrels of oil. It once produced over 2 million barrels of oil, a big portion of which went to the United States before relations between the two sides were severed in 2019. But there are challenges related to rapidly increasing Venezuelan oil production and exporting it to the United States, including Venezuelan relations with Russia on the one hand and its run-down infrastructure on the other. Three years ago, the country suffered a sharp decline in foreign investment after its relations with the United States broke down.

Losses and Bleak Forecasts for Energy Consumers

At the present time, the energy-intensive countries in the industrialized world will be the hardest hit by the current surge in prices — like the United States, Canada, Germany, France, the UK, Japan and South Korea. Developing countries will also suffer like India, China, and many Southeast Asian countries along with other countries to varying extents.

The European Union countries, especially Germany, plus the United States, China, India, and Japan are considered the biggest oil importers in the world and will be the hardest hit by the rise in its prices. Several Arab countries that import oil in large quantities such as Egypt, Tunisia, Lebanon, Jordan and Morocco will also be impacted. The countries to be impacted by the surge in gas prices include Germany, Japan, China, and the United States, deemed the world’s biggest gas importers.

In the short term, the excessive surge in energy prices could harm the growth of the global economy and hurt importers as well. Furthermore, exporters may suffer if price hikes continue for some time. Soaring energy prices increase the cost of production and diminish global demand and consumption. This could eventually lead to the world entering an economic recession — where demand for oil plummets, prices decline to unprecedented levels and national budgets face revenue crises. This previously happened in 2016 when oil prices dropped to less than $40 per barrel, which occurred again in 2020 (see Figure 1) due to the global recession against the backdrop of the coronavirus pandemic. Some major oil producers believe that $100 is a fair price for a barrel of oil.

As for Europe, the harm is compounded. It imports intensive amounts of both oil and gas from abroad. It is suffering from energy hikes on the one hand, and fears Russia will cut off supplies on the other. Russia provides Europe with a huge amount of gas which cannot be supplied by any alternative source in the near future. No less than 40 percent of overall European gas imports come from the Russian pipelines passing through Ukraine. This is a major weakness for Europe.

Germany, France and Britain are the largest industrialized economies in Europe and the most harmed by the surge in energy prices. Their industrial production will be impacted, and energy bills will increase for both producers and consumers alike. This concern comes at a time when the aforementioned economies have not yet recovered fully from the economic recession or inflation following the lockdowns to control the coronavirus pandemic. For instance, estimates by The Independent newspaper indicate that British families will face an increase of up to $50 billion in home energy bills because of the hike in energy prices. The European governments will no doubt be prompted to offer some kind of financial support to suffering families.

Thus, the growth of the global economy is likely to suffer a severe shock in case energy prices continue to rise to unprecedented levels if the Russian-Ukrainian war continues to rage. Most economies suffered recessions throughout 2019 and 2020. They began to see limited recovery in 2021 and it was expected that the recovery would continue through 2022. But the war and soaring energy prices will significantly impact the aforesaid forecast. Perhaps the world will be plunged into a recession once again, with global production and demand plummeting. Economic recession brings with it soaring prices. The world is already experiencing a sharp rise in the prices of industrial and food items as well as services not seen for decades in some industrial economies such as the United States and Europe, while developing economies face the prospect of inflation doubling.

The crisis of soaring food prices is inseparable from the war and energy prices. It is influenced by several factors, including the prices of raw materials and energy for production, harvesting and agriculture. In addition, the Russian-Ukrainian war has impacted grain exports from Russia and Ukraine — both of which are among the world’s most important countries in terms of producing wheat, barley, corn, food oils and others food items.

The Food and Agriculture Organization (FAO) predicts a potential spike in food prices, reaching approximately 20 percent. Table 1 illustrates the annual changes which have recently impacted the most important international food and industrial items. Some of them, like wheat, saw a significant increase of up to 66 percent, corn 37 percent, livestock 16 percent, wood 60 percent, and cotton 60 percent.

Table 1: Price Changes in Major Commercial Items

Therefore, the disruption in the supply of food items will impact the entire world —particularly the countries which depend heavily on food imports, especially grains and meat such as most of the Middle Eastern countries along with many other countries worldwide. This could trigger social unrest in some countries. Meanwhile, we find that many industrialized countries have reduced their food vulnerability such as the United States, France and China, especially when it comes to basic items like grains. Hence, the impact of soaring prices will be less severe on their peoples. But on the other side, there will be an economic suffering of another kind as a result of soaring energy prices and their impact on raising the prices of most manufactured goods. Perhaps this will trigger a bigger crisis: low consumption, a decline in production and plunging the world into a new economic recession.

The Potential Economic Consequences of Surging Energy Prices

There is no doubt that oil has been a lever that Russia believed it could use to stave off escalation by the United States and the West since the first spark of the conflict. But with sanctions reaching unprecedented levels and impacting Russian exports, the bet of Russian President Vladimir Putin seems to have failed. The Russians, however, still possess an important and influential lever. The tremendous surge in energy prices has occurred while Russia has not been completely kicked out of the energy market yet.

Perhaps this lever is one of Putin’s most important ones in the face of the West. And maybe sanctions will open the door for Russia turning to China which shares the same revisionist ambitions toward the world order and anti-US sentiments. China will spare no effort to ensure that Russia does not collapse in the face of the United States and the West — despite Washington’s threats to China so that it does not help Russia to mitigate Western pressure and sanctions.

The energy crisis puts Russia and China in the same boat — like the political competition in the international arena against the United States. While the United States is intent on encircling China in the South China Sea and strengthening the Western camp, the rapprochement between Russia and China appears inevitable.

It does not make sense that the West is opting for imposing sanctions on Russia without taking into consideration the negative impact on energy supplies, particularly the ramifications on the global market and overall economic growth. It is important for the West to identify energy trajectories, especially for the United States, which is communicating with its allied oil producers. Moreover, the United States may opt to mend its relations with some of its foes in order to address the present energy crisis.

No doubt that the energy crisis will prompt the Europeans to be more effective in the international arena. The crisis has dealt a heavy blow to the stability of many European countries. European dependence on the United States to address political, economic and military crises is no longer sufficient. This European effectiveness will primarily extend into its geographical surroundings in the southern and eastern Mediterranean and the Euro-Asian sphere in order for it to boost its political and economic clout. As Russia is besieged, Europe will aspire more than ever before to play an active role in the international arena instead of retreat and dependence on the United States.

On the other side, the energy crisis has brought to the fore the importance of several regions that were no longer a key priority for the United States like the Middle East. The energy crisis enabled the Gulf states to restore an important lever — as did the energy crunch in the 1970s. In light of the energy crisis, it seems that the Gulf states want to recalibrate their relations with the United States. The Gulf states until now are rejecting international pressure and do not want to alter their oil policies. There is no doubt that the developments in the energy markets have given the Gulf states room for maneuvering among the current international blocs. The Gulf states had reservations about the US strategy toward the Middle East and its impact on regional security and stability. Maybe they have concerns about the United States opening the door for Iran in the future without taking into consideration the interests of its traditional allies.

But it seems there is no desire by the Gulf states to change the current international balances and turn eastwards. It is not clear yet whether or not the global order is open to change in light of rising powers and those competing with the United States. But the energy crisis has produced important bargaining chips which the Gulf states potentially can employ for preserving their strategic position in the current international balances. Maybe this could be achieved through meeting repeated Western demands to limit the surge in energy prices. This is in addition to meeting Europe’s energy shortfall if Russian oil and gas supplies are suspended amid Moscow’s invasion of Ukraine.

In the long term, the energy crisis will encourage oil importers to look for alternatives and adopt plans to shift to renewable energy. Maybe this will lead several oil-exporting countries to lose out on massive economic budgets and deprive them of an important bargaining chip in the face of the West and the United States. This will have ramifications on their standing in case they do not find economic alternatives that advance their leverage if oil is cut out of the political equation between the global powers.

In the same vein, for several oil-producing countries such as Iran and Venezuela that face tremendous US pressure, the energy crisis has provided them with an opportunity to potentially remove the sanctions imposed on them and reconstruct their international relations. The world needs the oil and gas of the two countries to enter the energy market to curb the excessive surge in prices, especially amid the sanctions imposed on the Russian energy market. The surge in prices is not expected to end anytime soon.

As for Iran in particular, if the sanctions are lifted, it will generate huge revenues —that it will not channel to address its domestic realities — hence strengthening the authority of the “hardline” faction led by the supreme leader. The new found revenues will support its regional reach and revitalize its militias, with Tehran aiming to shore up its regional clout.

The lifting of sanctions could trigger competition between Iran and its neighbors, especially in West Asia, while keeping in place its trajectory of moving eastwards toward China, Russia, Central Asia and the Caucasus. However, Iran’s aim is to maintain some sort of balance with the West.

It is not ruled out that some African countries will be a target for the gas-consuming European market. There are massive amounts of energy in the continent. But the major producers lack the necessary infrastructure —a gap that could be filled quickly. Nigeria, Angola, Libya and Algeria will be an important market when it comes to liquefied natural gas (LNG) imports given their geographic proximity. Long-standing European clout in the continent will lead to increased competition and production as well as more production in the Eastern Mediterranean and Gulf — given that all these countries are potential alternatives to Russian gas.

It is not ruled out that the ramifications of rising energy prices will fuel social movements in several countries — due to rising inflation, soaring prices, higher unemployment and governments failing to mitigate the consequences and protect their citizens. Such social unrest could pose a threat to the stability of some countries. Maybe if they widen in scope and exacerbate fragile political situations in some countries, some regimes could face collapse. This is reminiscent of the Arab uprisings in 2011. But this time the situation will be far worse.

Conclusion

It can be said that the future of energy prices cannot be predicted without considering the future of the dispute between Russia and Ukraine on the one hand and Europe and the United States on the other. This is because energy prices are a dependent variable. Not only energy prices but also the prices of all items everywhere in the world and the future of the global economy are now hinging on the future trajectories of energy supplies and the outcome of the war.

There is no doubt that the energy crisis will continue in case the dispute drags on and escalates between Russia and the West. The world may be plunged into a dangerous economic recession. This means we may see a further uptick in energy prices, which will lead to a rise in production costs and input prices and a disruption of port activities, which will be accompanied by a surge in insurance and shipping costs — let alone a crunch in food trade, price hikes, and the industry losing billions. Accordingly, demand and consumption will go down, rendering the economic recession deeper and more dangerous, especially in case it is accompanied by sharp rises in prices, or what is called stagflation. In this case, energy prices could substantially plummet as happened in 2015 and 2016 when the traditional oil exporters were impacted.

Provided the dispute is brought to a stop in the short term, it will surely be the best situation for energy prices — as well as for energy producers, consumers and the global economy. However, this does not necessarily mean the return to the situation that preceded the Russian invasion of Ukraine. This means that energy prices will stabilize at levels acceptable but higher than those reached before the start of the crisis. But Russia will remain a pariah for the West for a while, which will necessitate searching for alternatives to Russian oil and gas — as well as for a lot of raw materials and significant food items exported from Moscow. It is worth mentioning here that if the international geopolitical balance is restored, the economic turmoil will definitely end. Only then, energy prices are likely to stabilize instead of the sharp and swift fluctuations, which will mean much more stable energy demand as well as positive trajectories for economic growth in the industrialized and developing countries. In addition, stock markets and global trade will stabilize and global food security will be ensured.

In relation to the energy crisis’ political implications created by the Russian-Ukrainian war, the expected plan to address the crisis and avert its repetition in the future may lead to reshaping new alliances and balances for several countries. Maybe the supply lines of gas and energy will turn into new geopolitical passages, allowing for the creation of new alliances and blocs. In addition, this crisis will resurrect several energy transfer projects in multiple countries and push the economy to be an important locomotive for wider political alliances in the long run.